This is just getting sad:

Even if we calculate the sales commission at 3% rather than 5% to reflect the recent NAR settlement, their losses still total $190,000 – not to mention tens of thousands in renovation costs.

When you’re upside down and can’t sell it or rent it, what do you do?

Some would make it the bank’s problem.

***********ORIGINAL POST BELOW***********

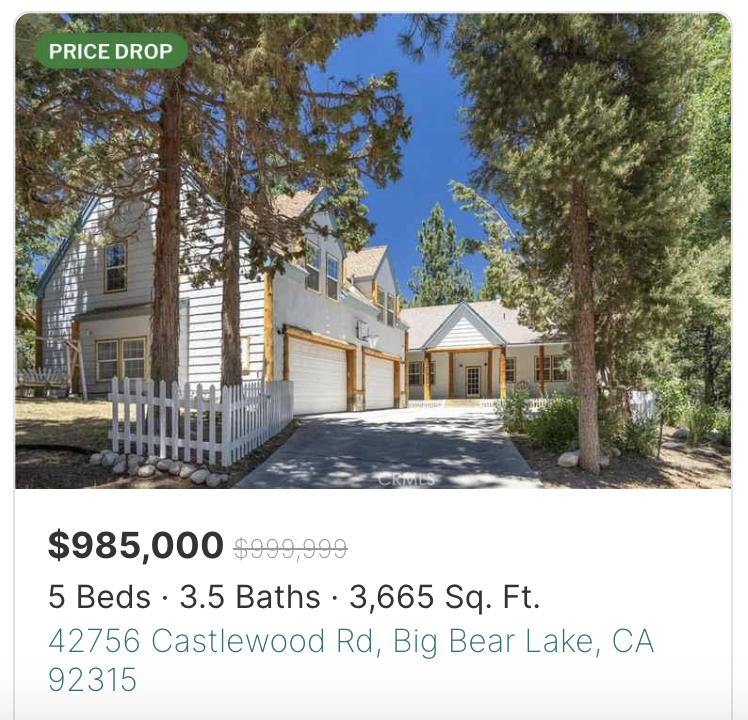

Address: 42756 Castlewood Rd, Big Bear Lake, CA 92315

Link: https://www.zillow.com/homedetails/42756-Castlewood-Dr-Big-Bear-Lake-CA-92315/17390045_zpid/

Beds/baths: 5 bed, 3.5 bath, 3,665 squares

Purchase Price (7/2023): $1,145,000

Asking Price: $999,999

Difference: -$146,000

Commission (5%): -$49,950

Total Gain/Loss: -$195,950

Damn, this is going to hurt.

According to Zillow, our seller purchased exactly one year ago for a whopping $1,145,000. Less than three months later they tried to flip it for $1,270,000, a price that just so happened to cover sales commissions and carve out a nice little profit for all their “hard work.”

But after hearing crickets from buyers they embarked on an eight-month journey of chasing the market down…

$1,245,000

$1,200,000

$1,500,000

$1,099,999

$1,049,999

…each time hoping that would be the magic number to entice a buyer.

And today they’re begging for $999,000, representing a loss of nearly $200,000 – almost their entire 20% down payment.

The good news is, assuming this thing sells today they will be able to salvage about $30,000 of their down payment. So not a total loss, but still pretty excruciating.

But making matters worse is the appearance that our flipper spent a decent amount of money fixing this place up. At the very least it looks like new carpets, hardwood flooring, paint and possibly a new shower in the primary bathroom ($). I don’t know what all of that cost, but we can conservatively assume it’s in the tens of thousands of dollars.

They saved some cash by not springing for a refrigerator. I guess that’s the next owner’s problem?

They also saved a few bucks by reusing the outdated, almond-colored light switches and outlets.

The two-bedroom guest house is a major plus, and that kitchen even has a refrigerator!

Albeit one from 1989.

I’m also loving those exposed fluorescent lights in the ceiling. Woof.

And sorry, there is no way this railless staircase meets code. I guess they’re making that the next owner’s problem too.

Speaking of the next owner, what kind of payment are they looking at?

Purchase price: $999,000

Down Payment (20%): $200,000

Monthly Payment: $6,793/mo (@7.3%)

Holy moly.

The market has made it clear that a million bucks for this place is not going to happen. So what happens if our seller has to drop the price to, say, $950,000 to find a buyer? Well, that would wipe out their entire down payment and they would have to cut a check for like 20 grand to avoid a short sale.

And if $950,000 won’t get the job done, then he’s left with only three unappealing options:

- Keep eating shit on those hefty carrying costs (like $7,700 per month) in perpetuity until he can break even; or

- Forfeit his entire down payment and improvement costs, ask the bank for a short sale to cover the rest, then pay taxes on the forgiven amount; or

- Let it go into foreclosure and absolutely destroy his credit.

Notably, there is no option #4 where the Federal Reserve suddenly cuts interest rates, asset prices skyrocket again and every half-assed flip magically gets bailed out. I know that’s what lots of people are hoping for, but it ain’t happening.

There is no magic solution here. Recent buyers need to pick their pain.

What do you think?