For those keeping track, a sale at the new price would result in a brutal $71,250 loss. Oddly though, I don’t get the sense that they’re panicking.

They know they can still salvage about half their down payment, so they’re probably not thinking utter devastation is a realistic outcome. But I bet losing money on real estate also didn’t seem realistic at one point in time. How’d that work out?

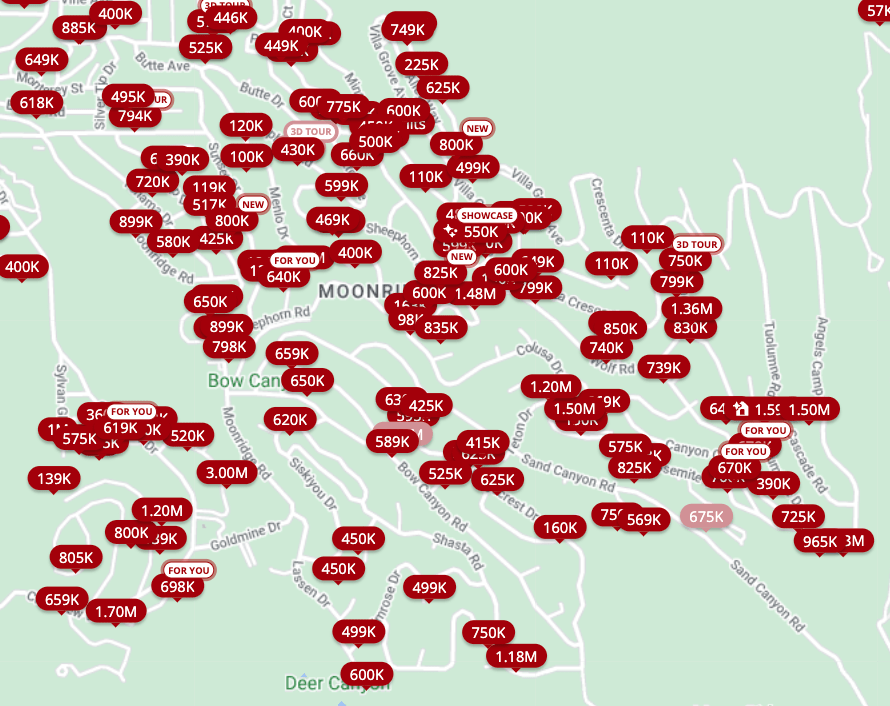

As noted in the original post, Moonridge is absolutely inundated with recent buyers desperately vying for the same handful of qualified buyers. Maybe this seller will get lucky and find someone to pay full boat, but I have a feeling more price cuts are on the way.

********ORIGINAL POST BELOW********

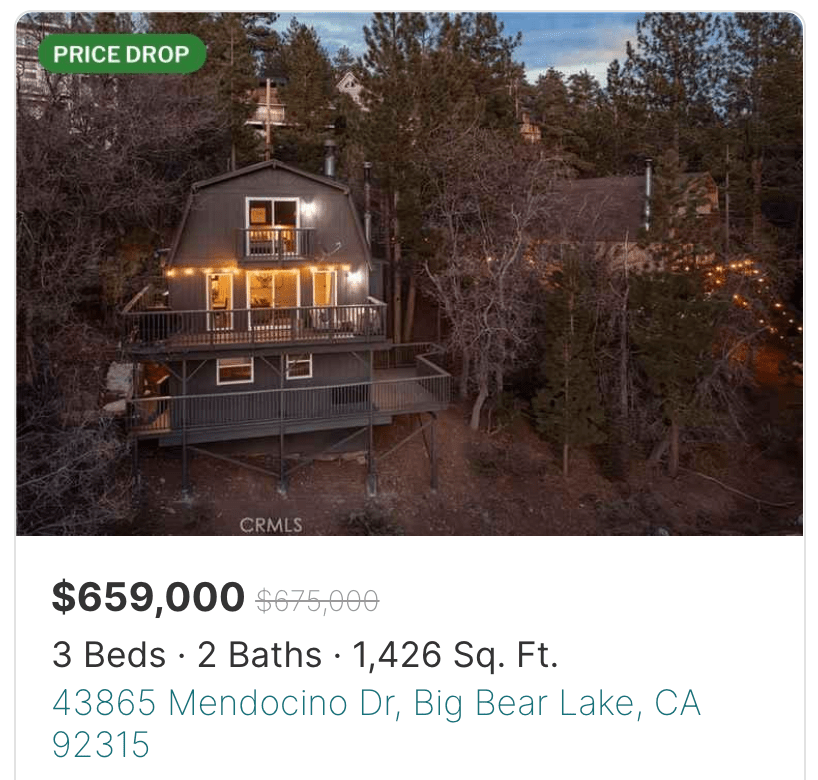

Address: 43865 Mendocino Dr, Big Bear Lake, CA 92315

Link: https://www.realtor.com/realestateandhomes-detail/43865-Mendocino-Dr_Big-Bear-Lake_CA_92315_M19823-90567

Beds/Baths: 3 beds, 1.5 bath, 1,426 squares

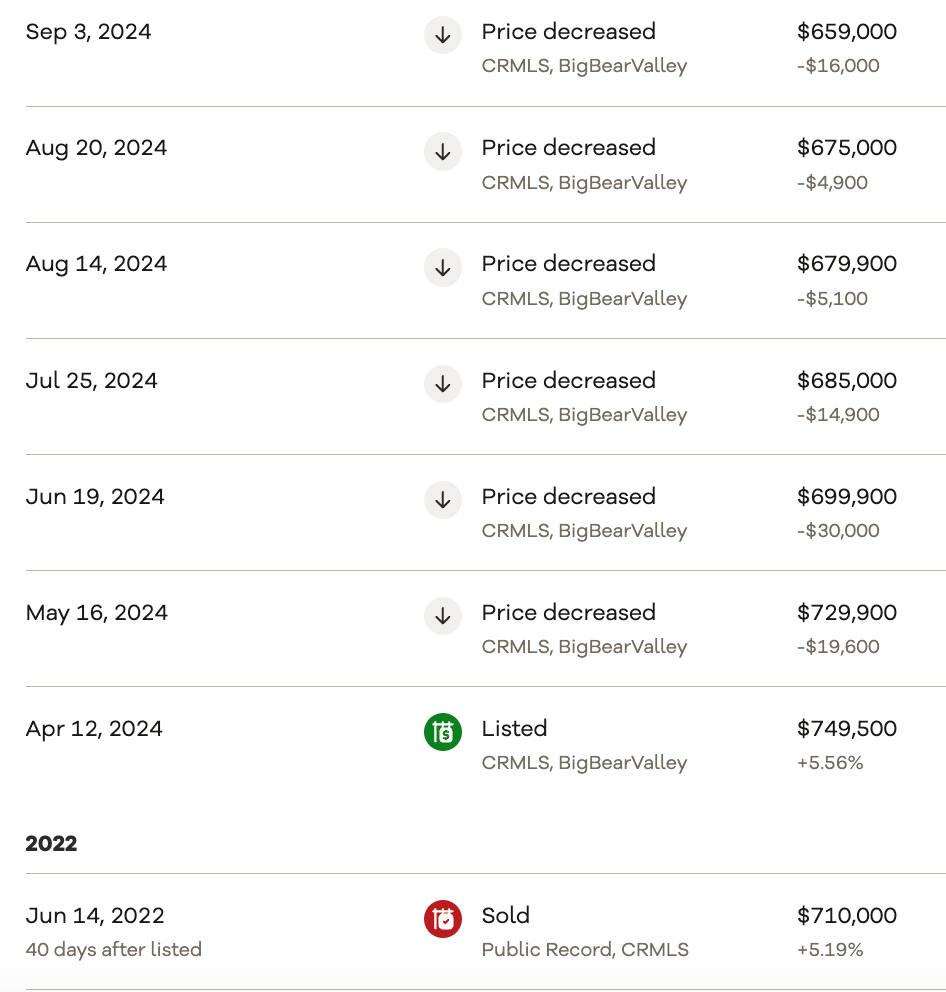

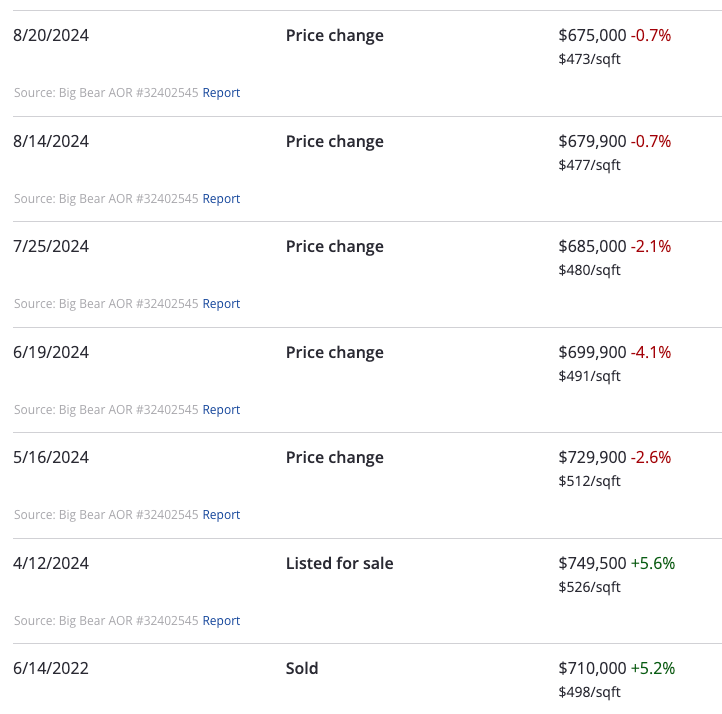

Purchase Price (6/2022): $710,000

Asking Price: $675,000

Difference: -$35,000

Commission (3%): -$20,250

Total Loss: -$55,250

In June 2022 our seller paid $710,000 for this place, which was $35,000 over the asking price. OOPS.

In April of this year they listed for a Washing Price of $749,500, which was met with total silence from the buying public. To the seller’s credit they quickly started cutting the price and today they’re pleading for $675,000 – representing a $55,000 loss after commissions.

But at this point the property has been rotting on the market for 143 days with no signs of serious buyer interest.

The place looks super dialed in, although it has clearly been given the ASS treatment (Airbnb Standard Sprucing) because there are no kitchen cabinets, just open shelves. I hope you like dust bunnies in your Cocoa Puffs.

Interestingly, someone bought this place during the last peak (2007) for $320,000. In 2019 they sold it to someone else for just $279,000 – a $41,000 loss. The 2007 buyer hung on to it for 12 years and still lost money!

If that 2007 buyer had just waited another 36 months to sell, he could have been the one to dump it on this fool for $710,000+. I really hope the 2007 buyer doesn’t know about Zillow or Redfin, because that’s gotta be tough to see.

Anyhow, the only question that matters for the current seller is whether his $675,000 asking price is competitive. Here are the basics:

Purchase price: $675,000

Down Payment (20%): $135,000

Monthly Payment: $4,585/mo (@7.3%)

This place is tidy, but that’s a pretty beefy payment for a second home. And Moonridge has a metric ton of unsold homes all competing for the same smattering of qualified buyers.

The good news is this place doesn’t seem to need a lot of work – that’s an advantage in this highly competitive market. But more price cuts are on the way if they truly want to sell.

What do you think?