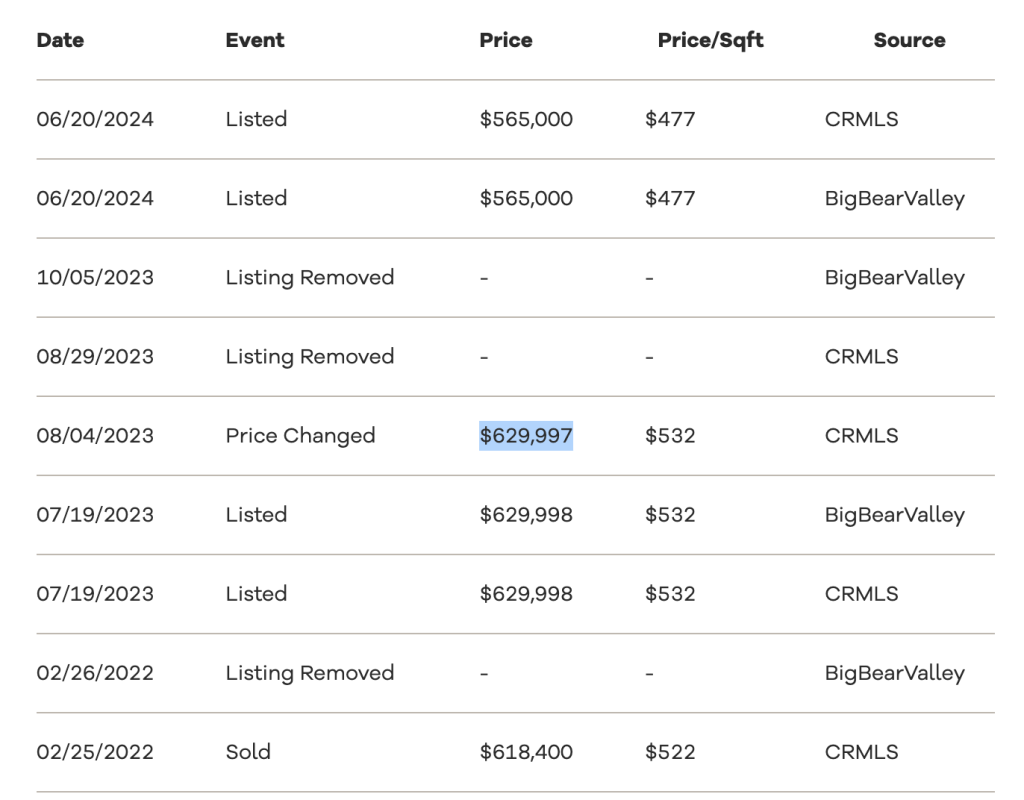

In addition to a $5,000 price “reduction” in August, today they cut another $11,000.

If we generously assume their closing costs will only be 3 percent of the sales price, they are now staring down the barrel of a -$85,870 loss. Finding a buyer today will allow them to salvage some of their down payment, but it’s looking pretty grim.

But maybe this will be enough to finally attract a buyer?

***********ORIGINAL POST BELOW***********

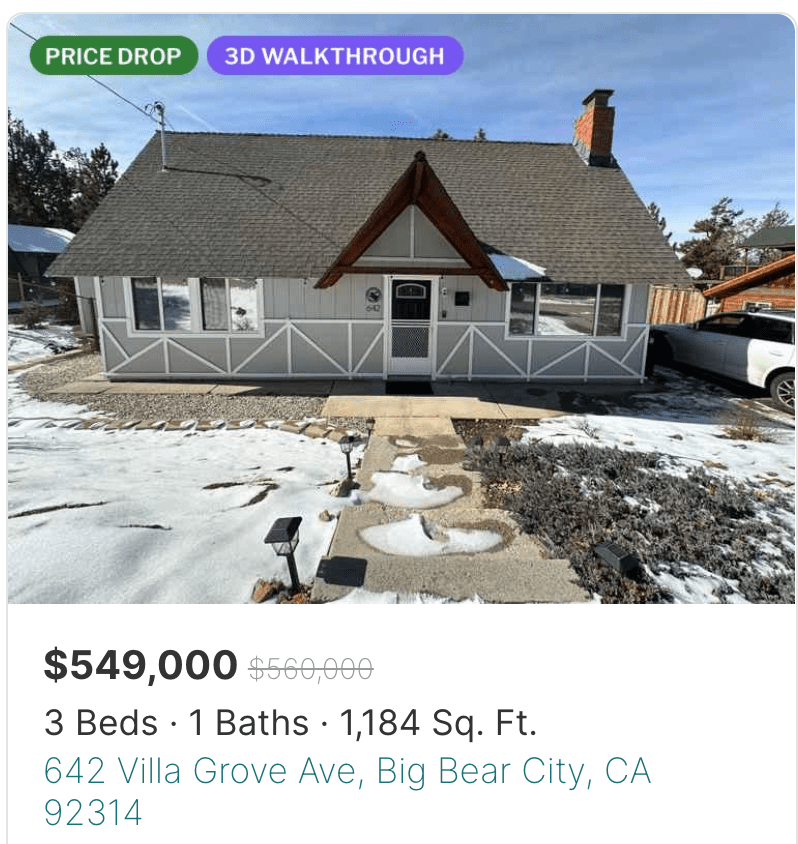

Address: 642 Villa Grove Ave, Big Bear City, CA 92314

Link: https://www.redfin.com/CA/Big-Bear-Lake/642-Villa-Grove-Ave-92315/home/4119285

Beds/Baths: 3 beds, 1 bath, 1,184 squares

Purchase Price (2/2022): $618,400

Asking Price: $565,000

Difference: -$53,400

Commission (5%): -$28,250

Total Loss: -$81,650

This listing history is fascinating. According to public records, in 1999 Buyer A purchased this place for $111,000. Three years later they sold it to Buyer B for $155,000. Making $44,000 in just three years must have made Buyer A feel like a Rockefeller!

If they only knew how crazy it would get.

Buyer B, who paid $155,000 in 2002, held on to it for 18 years before selling to Buyer C in 2020 for $335,000. Buyer B probably thought doubling his money was a pretty nice score!

If they only knew how crazy it would get.

Buyer C only owned it for a year, then in late 2021 listed it for $550,000. A vicious bidding war ensued and Buyer D bought it in early 2022 for an astounding $618,400. Buyer C probably thought nearly doubling his money in a year was a great return!

If they only knew how crazy it would get.

And Buyer D was probably stoked to win the bidding war and immediately started dreaming about how they would be able to double their money in a few years too.

If they only knew how crazy it would get.

Unfortunately for Buyer D, things got crazy in the wrong direction. After significantly overpaying in February 2022 – literally a month before the Federal Reserve started jacking rates – in July 2023 he tried to wriggle out of his predicament with a ridiculous asking price of $629,998.

Two weeks later he dropped the price to $629,997 – yes, a fucking dollar – then delisted in October 2023.

In June of this year he busted back on the scene with a $565,000 ask, fully acknowledging that a sale will result in a massive financial hit. If he manages to sell at today’s asking price he is staring down the barrel of an $81,000 kick in the teeth. Brutal.

And assuming they put 20 percent down, the most they can cut is $30,000 (to $535,000) before their entire down payment goes up in smoke. And considering he’s been stuck at $565,000 for more than a month with no love, I worry that a $30,000 price reduction won’t even be enough to get the job done.

I hope I’m wrong because this place is super clean and nicely updated.

The wild thing about this property is that it took 18 years (from 2002 to 2020) to double in value, but it only took one year between 2020 and 2021 to nearly double again – and that was at a higher nominal value! Speculative bubble, anyone?

And in case you are interested in purchasing this place, here you go:

Purchase price: $565,000

Down Payment (20%): $113,000

Monthly Payment: $3,869/mo (@7.4%)

The seller is probably having a serious debate right now regarding whether to aggressively cut the price, or just wait and see what the Fed does with rates in September (the market is betting heavily on a cut). But that’s the problem with waiting around in a volatile market:

You never know how crazy it will get.

What do you think?