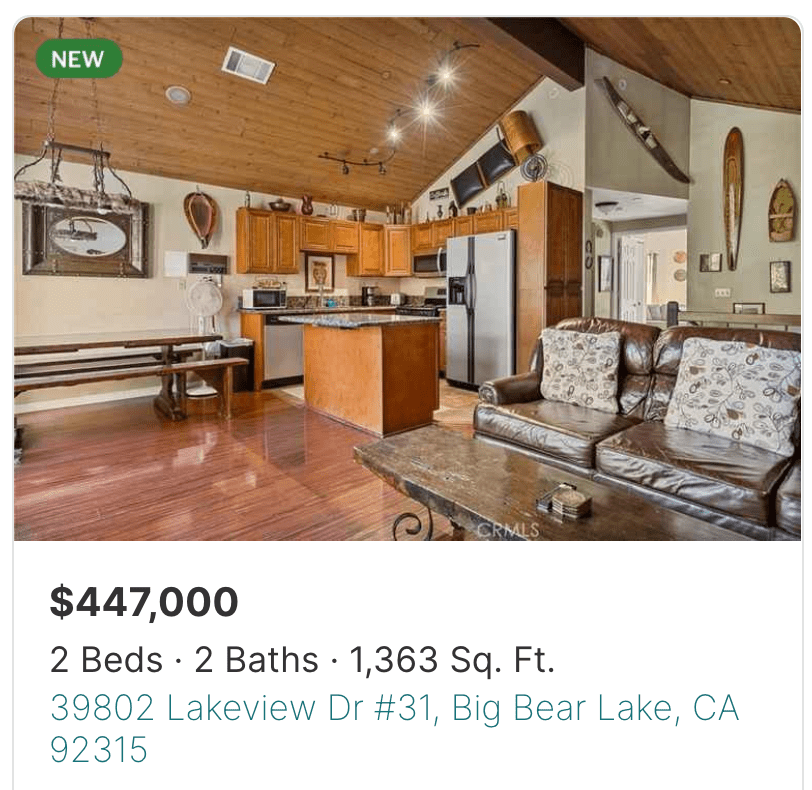

This listing is anything but “new.” They have been on the market since July 2023 messing around with Wishing Prices and playing the de-list/re-list game to obscure just how stale this listing is. There are currently four other properties competing for the same smattering of qualified buyers. How does our featured seller stack up?

The interior looks…fine.

But there are some oddities. For example, with the washer and dryer in the bathroom, how exactly are you supposed to sit on the toilet?!

And check out this absolutely FILTHY fireplace. Yikes.

After initially trying to get $510,000, they are currently asking $447,000 – a measly 12 percent reduction in price. They’re not in a hurry.

Which makes sense – they paid $367,000 in 2006 so they have 18 years of equity. In other words, the only thing preventing a sale is their moronic refusal to accept market price. And what is market price?

As noted earlier, the most recent comp in this building is $435,000 (Unit 20). Today’s featured property is a bit smaller than Unit 20, so I can’t imagine an appraiser would go above that.

On the other hand, Unit 10 is under contract for $595,000 (with an extra half bath and 400 more square feet). It’s tougher than ever to determine fair market value and whether you’re catching a falling knife, but if you have the cash and you love the property then you should go for it.

For all we know the bottom is already in.

************PREVIOUS POSTS BELOW************

$510,000 to $475,000. Awesome job!

The only problem is they waited too long to finally come to their senses.

Because on the very same day, their neighbor in Unit 25 – literally right next door – decided to slash their price from $475,000 to $459,900.

WELP.

This, my friends, is what we call Chasing the Market Down. And it’s a miserable gut-wrenching experience – especially for those desperately trying to avoid financial devastation.

For those of you who don’t feel like scrolling down to read the prior posts, here’s a refresher: the owner of Unit 26 paid $560,000 in 2022, meaning a sale at the current price of $475,000 will result in a $99,250 loss – basically their entire down payment. That’s right, one more price cut and they’ll have to write a check to get out of this mess.

But considering their next-door neighbor is now undercutting them by $15,000 (and still might not even get their price), cutting the price again is exactly what Unit 26 will have to do.

I wish sellers would listen when I tell them dicking around with unrealistic prices and chickenshit price reductions is just inviting increasingly desperate neighbors to swoop in and undercut you.

Remember, the last sold comp in this building is $435,000 (Unit 10). Based on that alone, both Unit 25 and 26 are in deep shit. But by violating the Spider-Man-Pointing meme (one of my best, if I do say so myself), Unit 25 retains the pricing advantage in the race to the bottom.

For now…

**********PREVIOUS POSTS BELOW**********

I keep warning sellers that waiting around for a miracle is a dangerous game. While recent buyers are understandably sensitive about pricing as they desperately try to minimize their losses, long-time owners with tons of equity don’t give a hickory-smoked shit.

And those are the people setting the comps.

In this case, the sellers of Unit #20 just let theirs go for $435,000 – a huge discount from their initial asking price of $500,000. But since they bought in 1988 for just $225,000 they could easily afford to take that kind of a haircut. It’s all gravy anyway so who cares?

Unfortunately, now the other desperate Viking Estates sellers have to contend with a comp in the low $400,000s. For anyone still on the market in that building it must be like a bomb went off.

And where does that leave our featured seller in Unit #26? Up a creek without a paddle. Still begging for $510,000, they now have to explain to every potential buyer why their place is worth $75,000 more than the last comp.

I’m sure some would point out that Unit #10 is in pretty much original condition and doesn’t show as well as our featured seller’s condo. And that’s a fair point. But keep in mind that 75 grand can buy a whooooooole lot of carpet and countertops.

Again, if recent buyers want to sit around and wait for their unicorn buyer to come along or the Fed to suddenly slash interest rates, that’s their prerogative. But they need to be aware of the very real dangers of a neighbor who has the headroom to undercut you to make a deal.

******************ORIGINAL POST******************

Address: 39802 Lakeview Dr #26, Big Bear Lake, CA 92315

Redfin: https://www.redfin.com/CA/Big-Bear-Lake/39802-Lakeview-Dr-92315/unit-26/home/3490702

Beds/Baths: 2 bed, 2.5 bath, 1,574 squares

Purchase Price (8/2022): $560,000

Asking Price: $510,000

Difference: -$50,000

Commission (5%): -$25,500

Total Gain/Loss: -$75,500

I need to reiterate how much I LOATHE when people rip out perfectly good kitchen cabinets in favor of open-air shelving. Setting aside the absolute hell it would be to deal with constant dust issues, aesthetically it just looks cheap and ugly.

Speaking of dodgy choices, I am shocked that massive hole next to the stairs passed the city inspection for rentals.

But I have to say this place looks really tidy with nice updates. I wish I could give the sellers credit, but it appears the previous owner did the majority of the work. Looking at the 2022 listing photos you can barely see a difference, down to the furniture (probably bought it from the previous owner, which was smart).

2022 Listing:

2024 listing:

They even kept the same framed artwork on the fireplace mantle!

The 2022 listing also shows our seller put a little mustard on his offer to close the deal at $560,000. Although they only overpaid by a modest $10,100, it shows how irrational exuberance was still alive and well in Big Bear at that time. Sadly for sellers, those days of paying over ask are long gone.

Since the seller didn’t invest much of their own cash into fixing the place up, that will lessen the pain when they finally find a buyer.

Speaking of that, we need to give the seller credit for admitting there is no way they will get out of their “investment” without a significant financial hit. Staring down a $75,000 loss right off the bat is pretty brutal but at least they will get some of their $112,000 down payment back. Enough to buy a base model Corolla?

But as always there is one big assumption built into my loss calculation – that the property sells today for full asking price. I hope for their sake they get lucky, but it’s not looking good.

With inventory from other pandemic-era buyers piling up, this seller needs to get aggressive NOW if they want to avoid incinerating their entire down payment. Frankly, I think they need to cut the price by five percent today and keep cutting until they get reasonable offers. But if they are following the Pandemic Purchase Playbook (PPP) that means they will stick to their guns and dole out the occasional 1-2% price reductions to keep the listing fresh on the Redfin and Zillow feeds, hoping for a unicorn buyer to swoop in and minimize their losses.

Unfortunately, by the time they realize they should have been cutting early and often, the Super Summer Selling SeasonTM will be upon them with even more sellers competing to get rid of their Big Bear Bummers. As it stands, it looks like their entire down payment will vanish unless they get super lucky and find a buyer today willing to pay full ask.

Are you that interested buyer? Here is what you are looking at:

Purchase price: $510,000

Down Payment (20%): $102,000

Monthly Payment: $4,168/mo (@7.5%)

The good news is that hefty monthly nut includes the $650 HOA fee, which likely covers most of your insurance. And you can always reduce your monthly expenses by renting it out on AirBnB – it certainly looks ready to go.

But if your rental income assumptions are too high then you’ll end up like this poor schmuck trying to offload to a greater fool when your brilliant plan doesn’t work out.

I actually really like this place and am hoping they see the light and cut the price very soon. Yes, it will suck to lose their entire $115,000 down payment after less than two years of ownership, but it sure beats having to write a check for tens of thousands of dollars on top of that.

What do you think?