Address: 41625 Thrush Ct, Big Bear Lake, CA 92315

Beds/Baths: 4 bed, 3 bath, 2,592 squares

Purchase Price (9/2023): $1,062,500

Asking Price: $1,195,000

Difference: +$132,500

Commission (5%): -$35,850

Total Gain: +$96,650

I admire the brass balls on these people. After buying barely a year ago for $1,062,500, they are now trying to unload their malignant mistake for a six-figure gain. I’m not sure what convinced them that 2023 buyers are able to flip houses for big profits, but here we are.

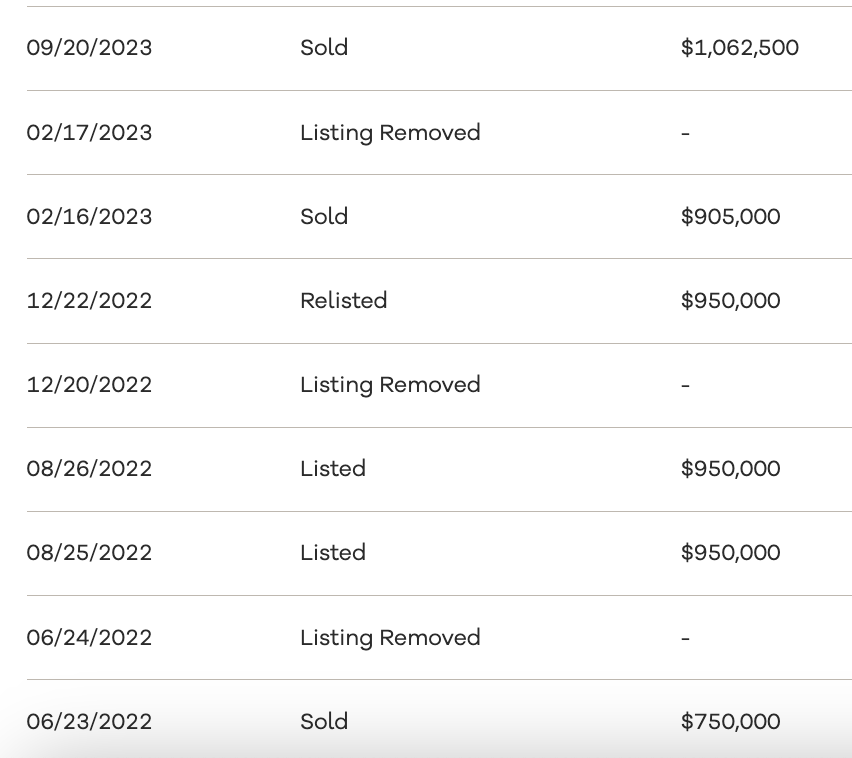

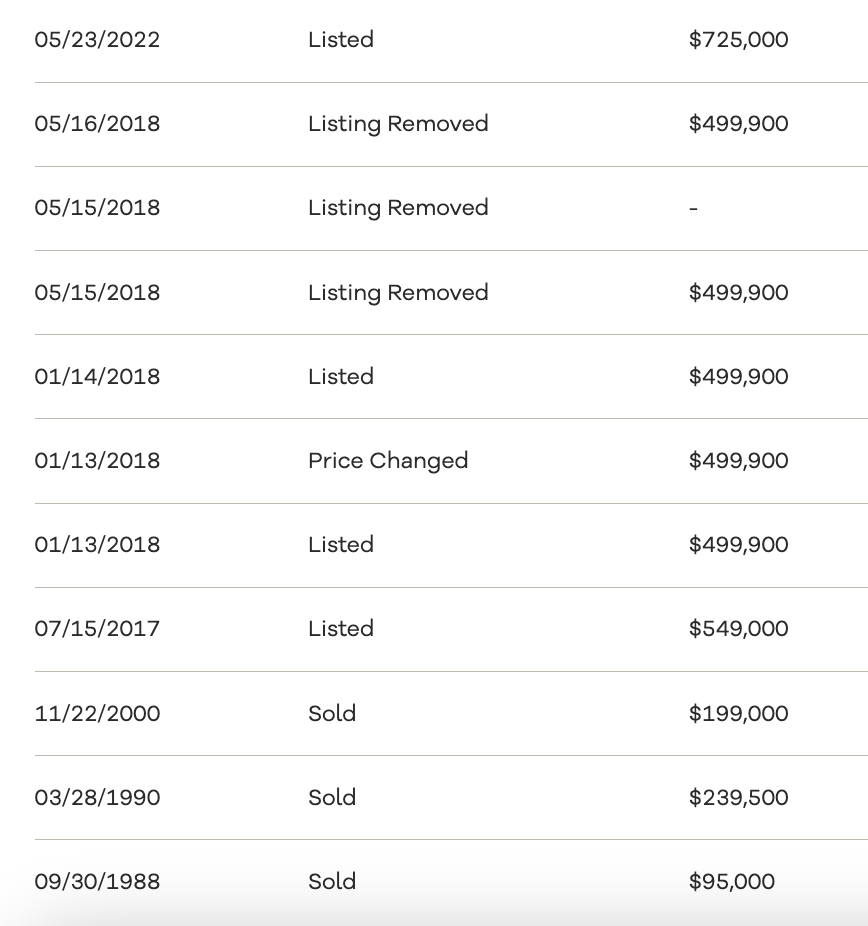

The listing history shows this was quite a hot potato:

What a remarkable illustration of a housing bubble. This thing sold for $750,000 in June 2022, then just eight months later in February 2023 it sold for $950,000. Seven months later it sold again for $1,062,500 (yes, it sold twice in 2023). Unfortunately, in a speculative bubble someone always get left holding the bag, and that someone is today’s featured seller.

The problem is they don’t realize it yet.

Despite paying over a million bucks at the absolute peak of the market, they still somehow expect a buyer to fork over $1,195,000 and help them walk away with a $96,000 profit.

The good news is this place has been fully renovated and looks super nice, if a bit sterile.

But keep in mind these sellers didn’t put a dime into this place – it was already fully renovated when they bought it. I just don’t see how they justify this asking price.

There are clearly some cashed-up morons out there, but I think even they would blush at this monster payment:

Purchase price: $1,195,000

Down payment: $239,000

Monthly nut: $7,904/month (@7%)

I get that it’s walkable to Snow Summit (major plus), but only a complete idiot would pay eight grand a month for this place.

Look, it’s only been a week. They need some time to marinate on the market with no offers before they can snap out of their delusion-driven hypnosis. But they clearly believe they deserve a fat profit for their “investing skills,” so I wouldn’t hold my breath for a price cut that would involve actually losing money.

What do you think?