The good news is they still made a fat profit. The bad news is because they wasted 2+ years farting around with ridiculous asking prices they left a bunch of money on the table. Had they just priced it reasonably from the outset they would have made an absolute killing.

Although the final sales price of $459,000 ($22,000 over ask!) is a far cry from their original delusion-driven demand of $624,900 in 2022, they still did just fine with a profit of $207,000 after commissions. That’s fantastic, but at what cost? They have been dealing with open houses, inspections, tire kickers, “lowball” offers, price cuts and all the hassles of selling a home for TWO YEARS.

As to the new owner, their monthly payment is about $3,000 – not terrible for 1,360 square feet. But the real question is: Are they catching a falling knife?

Frankly, I don’t think so. Until I am convinced otherwise, my sense is that the bottom is quickly approaching.

**********PREVIOUS POST BELOW**********

Address: 436 Dixie Ln, Big Bear Lake, CA 92315

Link: https://www.realtor.com/realestateandhomes-detail/436-Dixie-Ln_Big-Bear-Lake_CA_92315_M29724-02483

Beds/Baths: 3 bed, 1 bath, 1,360 squares

Purchase Price (7/2020): $224,500

Asking Price: $437,000

Difference: +$212,500

Commission (3%): -$13,110

Total Gain: +$199,390 (!)

Here is another example of dumb money thinking it’s smart money.

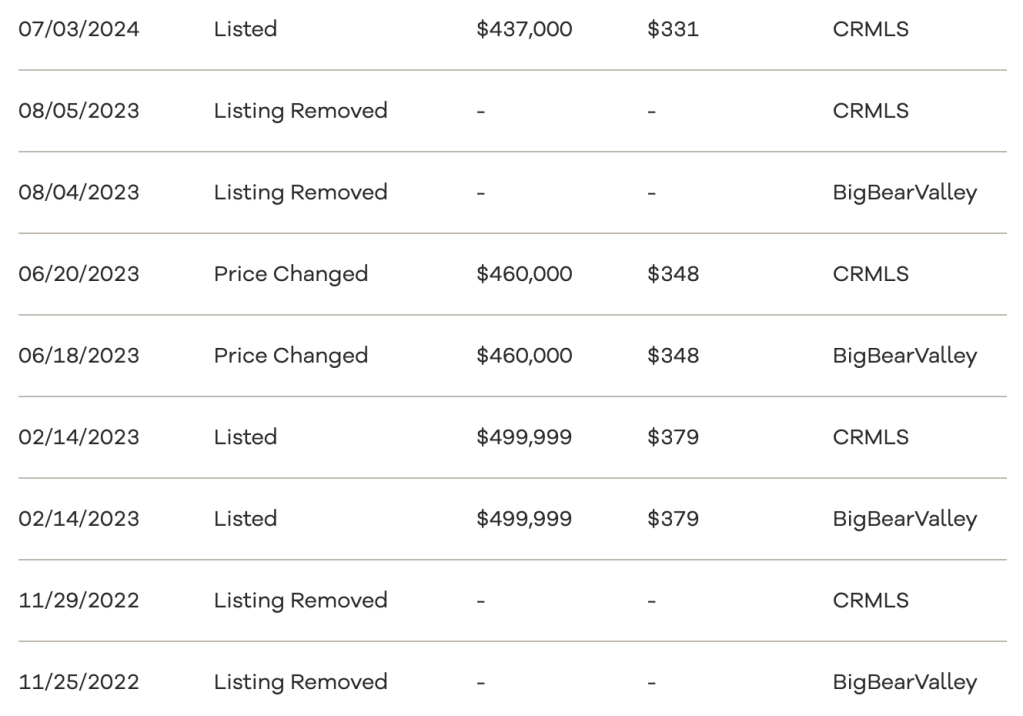

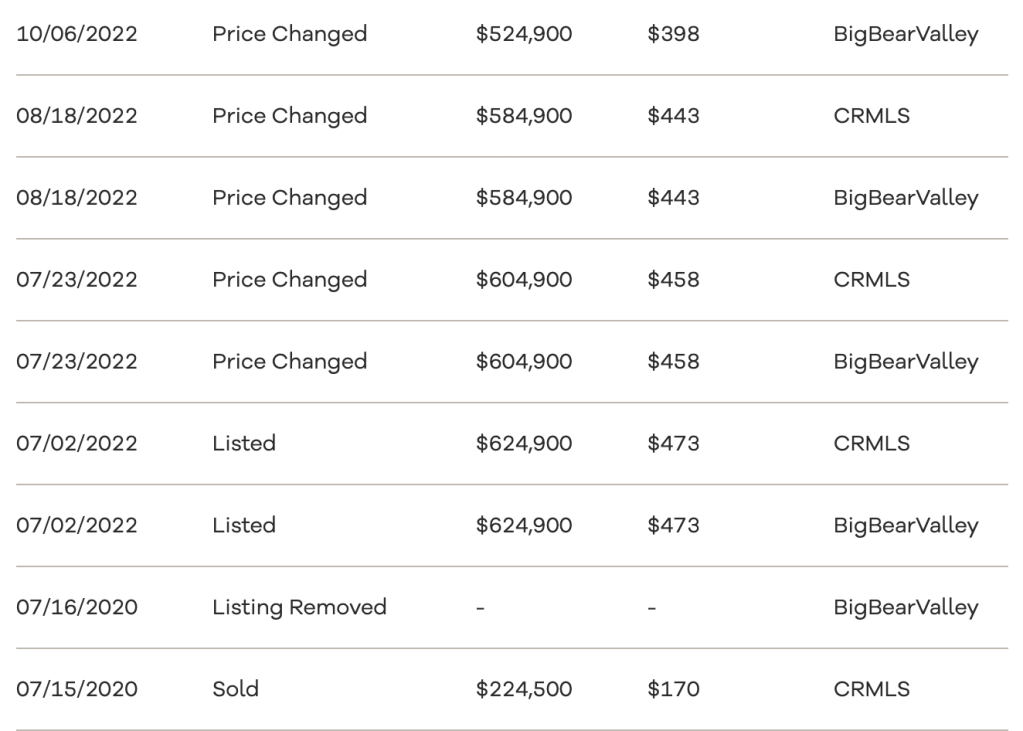

Our seller bought this modest home in July 2020 for a paltry $224,500 and convinced themselves it was a winning lottery ticket. In July 2022, exactly two years after they purchased, they listed for $624,900 – an astounding 178-percent appreciation rate in just 24 months.

That amount of greed and delusion is seriously impressive.

Now, humbled by two long years on (and off) the market, they are begging for $437,000 – meaning they will “only” double their money after four years of ownership.

What a journey:

The sad thing is if they had just priced it reasonably in 2022, they would have walked away with a ton of money. That was the peak of the pandemic-era frenzy, with FOMO-fueled buyers overpaying for every crap shack they could get their hands on. An attractive price would have guaranteed a bidding war and a huge profit.

But instead they chose to live on Fantasy Island, and their feckless realtor failed to dispel their delusions about what their house was “worth.” And although the current asking price of $437,000 seems a lot more reasonable than their bonkers opening salvo of $624,900, it might be too little, too late.

For one thing this place is pretty mid:

The solo bathroom looks pretty good though:

Here is what a new buyer is looking at if they pay today’s asking price:

Purchase price: $437,000

Down Payment (20%): $87,400

Monthly Payment: $2,835/mo (@7.4%)

That seems like a reasonable payment, but obviously the market feels differently. Keep in mind they have been stuck at $437,000 since July 3 with no action. More price cuts are needed if they want to sell.

And even if our seller decided to slash the price significantly, they could still walk away with a nice, healthy profit. Certainly not the $400,000 bonanza they were initially banking on, but $150,000+ is nothing to shake a stick at.

But they can’t seem to get past their pride.

And I get that they have a lot of cushion and aren’t in a hurry to sell, but what if the economy takes a turn while they’re taking their sweet time lowering the price? What if someone in the neighborhood with even more equity sets a brutally low comp?

Smart money gets out before dumb money even has its morning coffee. After two years of refusing to take their considerable profits, this seller is still wiping sleep boogers out of their eyes and brewing their first cup of Folgers.

What do you think?