Finally, someone took my advice! On October 28 I wrote:

They might be able to ride out the winter with income from short-term rentals, but the listing description doesn’t mention this being used an Airbnb. If that’s the case, they need to get serious about pricing right now. Interest rates are on the rise again and fire insurance only continues to go up (if you can get it)…this is a bad situation poised to get even worse if they don’t act fast.

Well, they got serious and accepted $15,000 under list to get the deal done. Based on their $700,000 purchase price, their total loss was $132,000 assuming they only had to pay their agent’s commission. Keep in mind their down payment was $140,000 – this had to hurt.

But at least they got it over with.

**********PREVIOUS POST BELOW**********

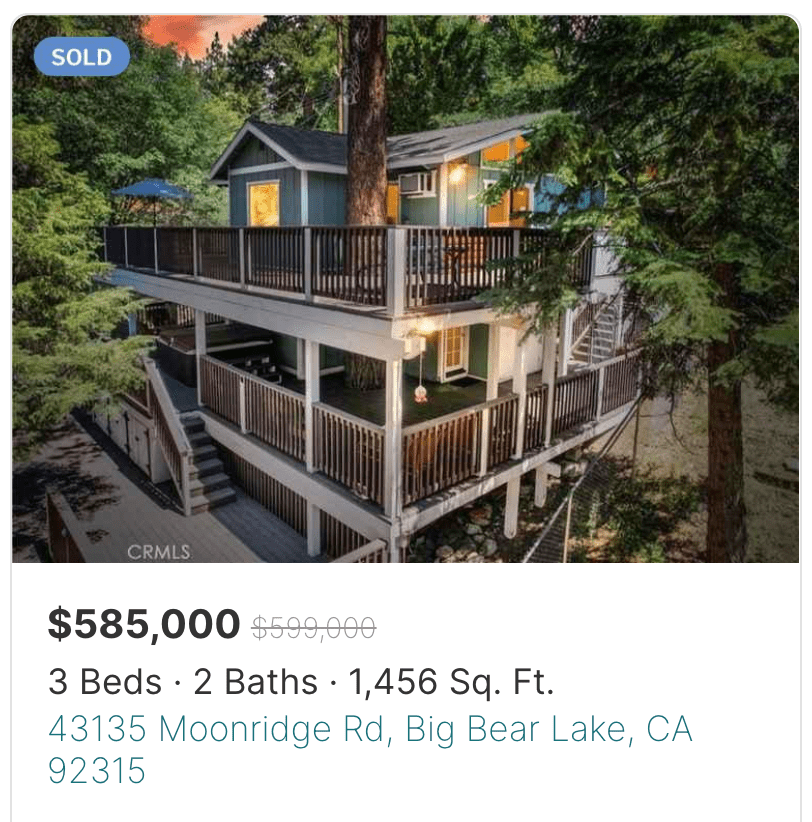

Address: 43135 Moonridge Rd, Big Bear Lake, CA 92315

Redfin: https://www.redfin.com/CA/Big-Bear-Lake/43135-Moonridge-Rd-92315/home/3510597

Beds/Baths: 3 bed, 2 bath, 1,456 squares

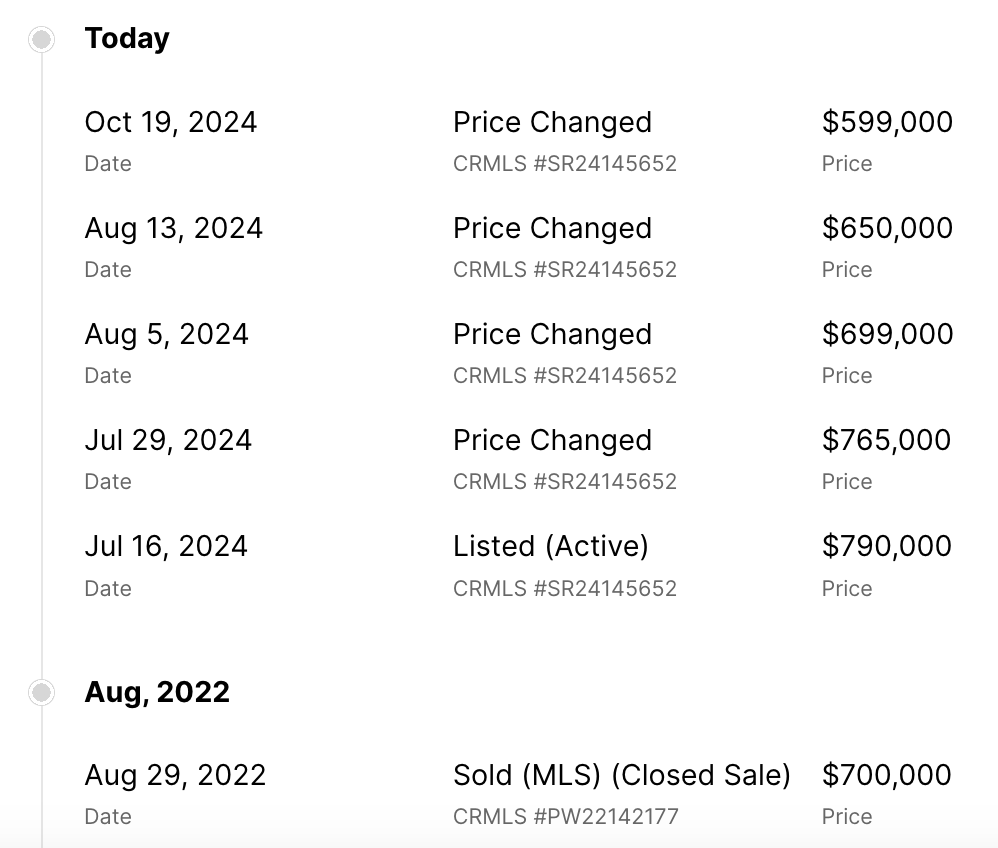

Purchase Price (8/2022): $700,000 (OUCH)

Asking Price: $599,000 (DOUBLE OUCH)

Difference: -$101,000

Commission (3%): -$35,940

Total Loss: -$136,940

It keeps getting worse for recent buyers.

This poor soul paid $700,000 in August 2022 and is now willing to take a $136,000 loss to be free of their financial prison. Considering their down payment was $140,000, this is shit-your-pants-and-pray-for-heavenly-intervention time. They cannot lower the price any further without writing a check at closing.

This is actually really sad. Witness their journey through the five stages of grief (Denial, Anger, Bargaining, Depression, Acceptance):

The property itself looks…fine. The green carpets and old-school decor are kind of charming, but otherwise this place doesn’t really stand out.

I’m not sure why you would take a photo of this nastiness under the deck, but at least they’re upfront about the next owner’s to-do list? A quick power wash or fresh coat of paint would have gone a long way, but with such a catastrophic loss on the horizon…why dump any more money into it?

However, I should point out this massive tree going through the deck. That’s pretty cool.

Anyhow, the only thing that matters is whether the monthly payment low enough to attract a buyer. Let’s explore:

Purchase price: $599,000

Down Payment: $120,000

Approx. Payment: $3,972/mo (@7%)

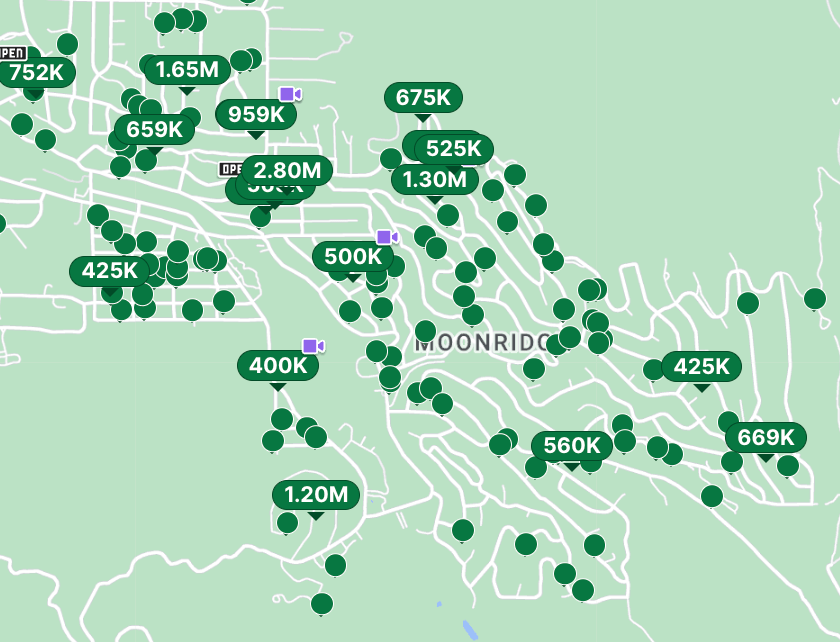

Considering you get two properties for that monthly payment, that doesn’t seem too bad. However, is it low enough to stand out among the hordes of competing sellers in Moonridge?

Their odds aren’t great. They’ve been listed since July (102 DOM) with absolutely no interest, and as noted above any further price cuts will result in significant financial pain beyond sacrificing their entire downpayment. The listing description claims, “REDUCED AND PRICED TO SELL!” but only the market can determine the truth of that claim.

They might be able to ride out the winter with income from short-term rentals, but the listing description doesn’t mention this being used an Airbnb. If that’s the case, they need to get serious about pricing right now. Interest rates are on the rise again and fire insurance only continues to go up (if you can get it)…this is a bad situation poised to get even worse if they don’t act fast.

What do you think?