After initially listing for a Wishing Price of $1,195,000 in October 2024, they knocked 100 grand off in November. That Washing Price of $1,095,000 would have allowed them to break even after commissions. How convenient!

Unfortunately, the house continued to rot on the market.

So on New Year’s Day they cut the price to $1,075,000, just $13,000 more than they paid in September 2023. A sale at this price will result in a relatively small loss of $20,000 after they pay their listing agent.

The question, as always, is whether this modest price reduction will be enough to attract a buyer, or if more cuts (and sacrifices to the price discovery gods) are required.

I’m betting on the latter for this hot potato.

***********PREVIOUS POST BELOW***********

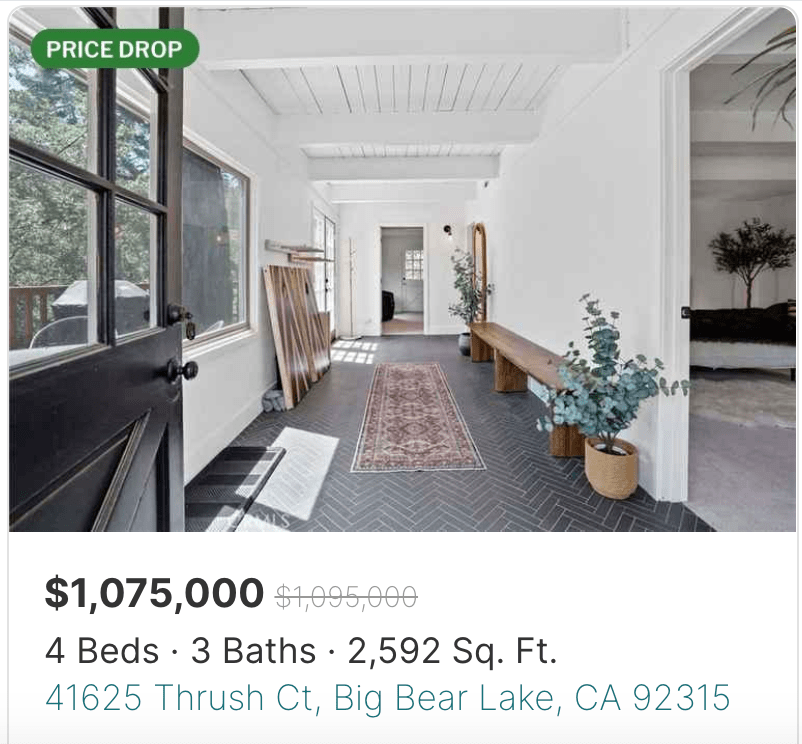

Address: 41625 Thrush Ct, Big Bear Lake, CA 92315

Beds/Baths: 4 bed, 3 bath, 2,592 squares

Purchase Price (9/2023): $1,062,500

Asking Price: $1,195,000

Difference: +$132,500

Commission (5%): -$35,850

Total Gain: +$96,650

I admire the brass balls on these people. After buying barely a year ago for $1,062,500, they are now trying to unload their malignant mistake for a six-figure gain. I’m not sure what convinced them that 2023 buyers are able to flip houses for big profits, but here we are.

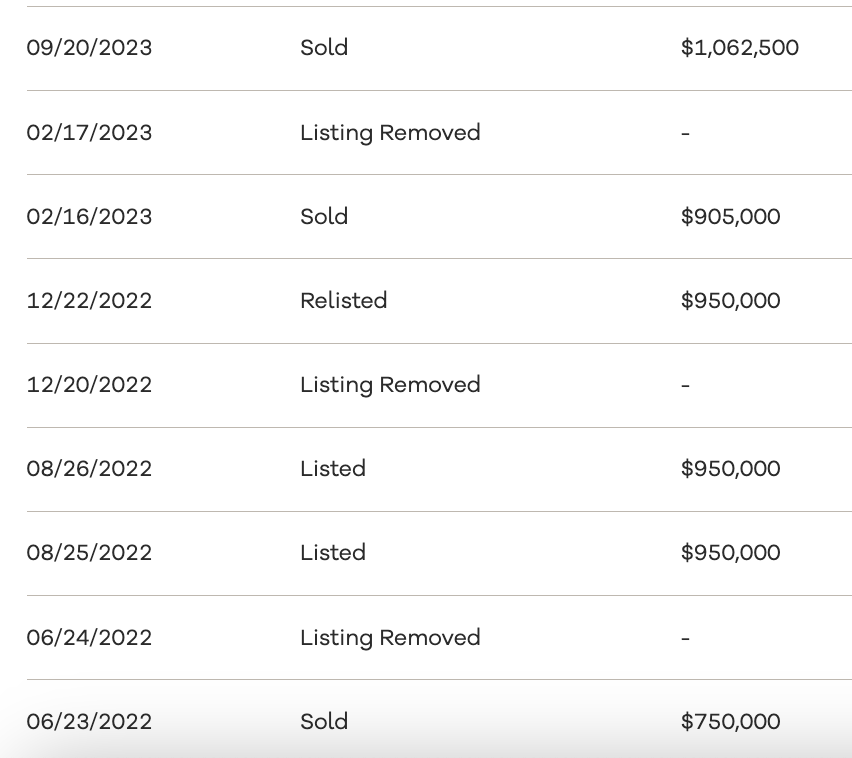

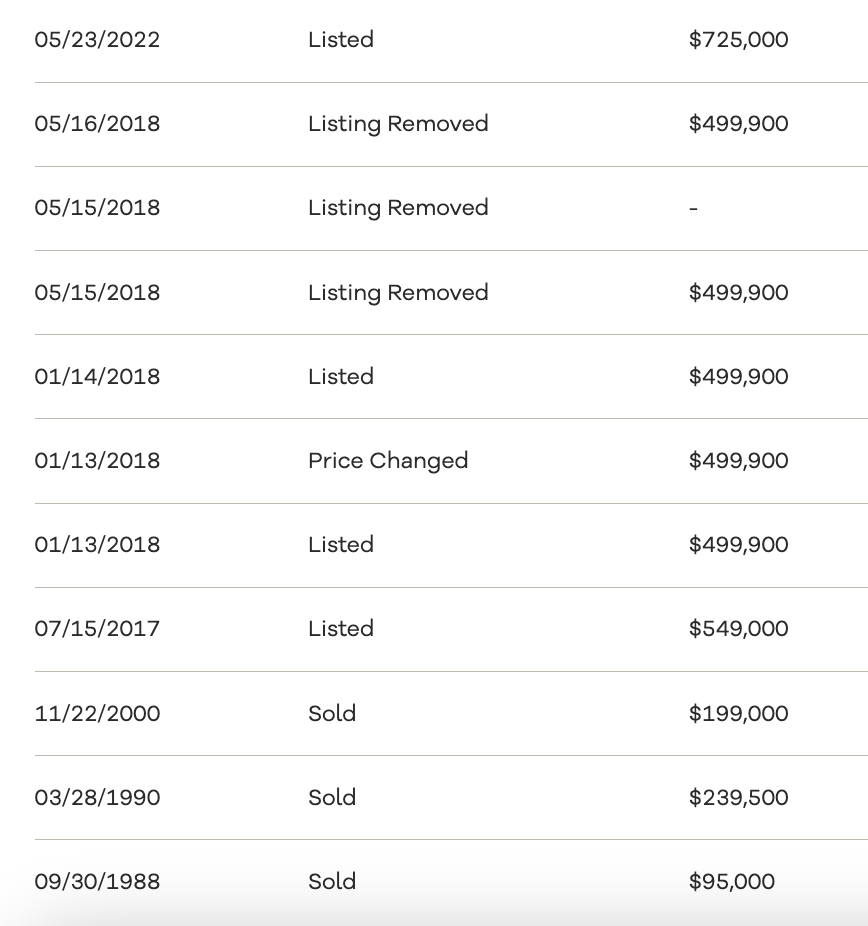

The listing history shows this was quite a hot potato:

What a remarkable illustration of a housing bubble. This thing sold for $750,000 in June 2022, then just eight months later in February 2023 it sold for $950,000. Seven months later it sold again for $1,062,500 (yes, it sold twice in 2023). Unfortunately, in a speculative bubble someone always get left holding the bag, and that someone is today’s featured seller.

The problem is they don’t realize it yet.

Despite paying over a million bucks at the absolute peak of the market, they still somehow expect a buyer to fork over $1,195,000 and help them walk away with a $96,000 profit.

The good news is this place has been fully renovated and looks super nice, if a bit sterile.

But keep in mind these sellers didn’t put a dime into this place – it was already fully renovated when they bought it. I just don’t see how they justify this asking price.

There are clearly some cashed-up morons out there, but I think even they would blush at this monster payment:

Purchase price: $1,195,000

Down payment: $239,000

Monthly nut: $7,904/month (@7%)

I get that it’s walkable to Snow Summit (major plus), but only a complete idiot would pay eight grand a month for this place.

Look, it’s only been a week. They need some time to marinate on the market with no offers before they can snap out of their delusion-driven hypnosis. But they clearly believe they deserve a fat profit for their “investing skills,” so I wouldn’t hold my breath for a price cut that would involve actually losing money.

What do you think?