This is only their second price cut in eight months, in case you’re wondering how deep their delusion goes.

A sale at this price will result in a $41,770 loss, but the market for these tiny shacks just isn’t there. If they truly want to sell then they need to drop the price below $300,000 and do it STAT.

But we all know they would walk away before they got that low because their entire down payment would vanish long before they got there. I still think this one is headed back to the bank.

********PREVIOUS POSTS BELOW********

Well, I didn’t say it was a meaningful price cut. But it’s a price cut nonetheless!

They paid $390,000, so what seems like a tiny price reduction to us feels like an enormous concession to the seller. Not that the market cares about any of that, but I at least sympathize with this seller’s reluctance to cut the price aggressively.

But this price simply isn’t going to get the job done. I still maintain there is no value proposition for a 529-square-foot hut unless the price starts with a two, but crazier things have happened.

Side note: It’s still unclear what the recent NAR settlement will mean for buyers and sellers, but lately I have been calculating the seller’s commission at 3% instead of 5%. I think going forward a lot of sellers will stop paying the buyer agent’s commission, meaning sellers will only be responsible for their own agent’s commission. So for purposes of this blog I think we should just calculate the seller agent’s commission at 3% and leave it at that. This is actually a best-case scenario for sellers since it will increase their profits/reduce their losses. In this case, assuming the seller is responsible only for their agent’s sales commission, the total loss will be $25,000.

**********ORIGINAL POST BELOW**********

Address: 40114 Esterly Ln, Big Bear Lake, CA 92315

Link: https://www.redfin.com/CA/Big-Bear-Lake/40114-Esterly-Ln-92315/home/3502898

Beds/Baths: 1 bed, 1 bath, 529 squares (!)

Purchase Price (3/2022): $390,000

Asking Price: $379,900

Difference: -$10,100

Commission (5%): -$18,995

Total Loss: -$29,095

Right off the bat, I respect the seller’s acknowledgement that walking away with a profit is not gonna happen. Although the current asking price of $380,000 represents a measly $10,000 discount from their 2022 purchase price, they clearly understand they will lose money on this transaction after sales commissions.

I actually like this place. It’s cute and eclectic and has some seriously chill, hippie vibes.

I mean, how can you not love this shredding bear?

There is some heavy handed “Live, Laugh, Love” stuff going on, but it works.

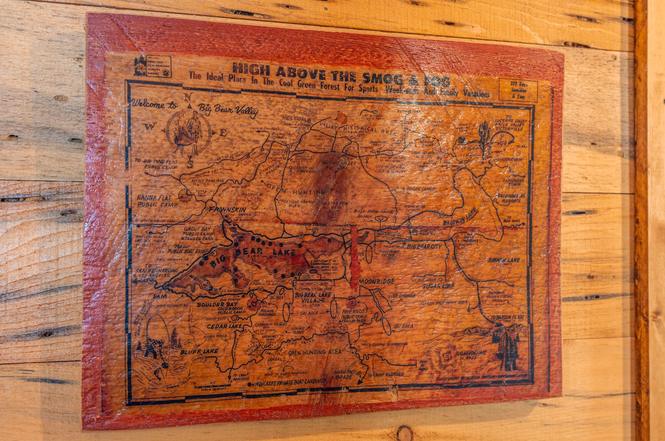

This “memory wall” is pretty groovy too:

Per the AirBnB Standard Sprucing (ASS) guidelines, they ripped out perfectly functioning kitchen cabinet doors for that “farmhouse” look.

Mmmmm, Cinnamon Toast Dust for breakfast…

This tiny, rustic cabin looks like a perfect spot to relax, enjoy the sounds of nature and, uh, maybe write a manifesto.

As much as I like this flower power hut, it’s never going to sell at this price. Just look at the payment:

Purchase price: $379,900

Down Payment (20%): $76,000

Monthly Payment: $2,601/mo (@7.4%)

That’s monthly nut is pretty far out for this little place, cuteness notwithstanding.

And if you plan to rent it out for extra cash, you will be forced to cater to an extremely narrow sliver of short-term rental clientele. Seriously, how many of you have ever searched AirBnB without selecting “two bedroom” as the minimum?

That means your rental pool is primarily limited to couples and solo travelers. That’s about it.

Not to mention your nightly rate needs to undercut nearby two-bedroom rentals by a considerable amount – otherwise why wouldn’t renters just throw down an extra $50 per night for way more space? That puts even more pressure on your margins.

The listing description claims this place “Has been a highly successful vacation rental; grossed over $32,000 in 2023!”

A few issues: 1) Gross revenue mean fuckall – especially when you factor in property management fees, rapidly increasing insurance costs and AirBnB’s generous cut, 2) Past performance is not indicative of future results, and 3) If it’s such a stupendous cash cow then why on God’s green earth would they let it go so soon, and for a $30,000 loss at that?

You know the answer.

This place, at this price, does not make financial sense and certainly does not pencil out as a short-term rental. If it did the sellers would just keep it instead of trying to offload it for a loss at one of the worst times in real estate history.

And no matter how adorable it is, at the end of the day this is a 529-square-foot, one-bedroom cabin built in 1932. I think a more realistic value, at today’s interest rates, starts with a two.

Yes, I said it.

I just don’t see how this makes sense as a purchase otherwise. The current asking price of $380,000 is a pipe dream.

For reference, this cabin on the same street with an extra bedroom and 35-percent more square footage can’t even get $360,000:

https://www.redfin.com/CA/Big-Bear-Lake/40137-Mahanoy-Ln-92315/home/3503287

It’s worth noting that if our seller accepts anything below $330,000, their entire down payment will evaporate. So that’s the floor and I understand why they desperately want to avoid hitting it. But if they don’t get serious about price cuts soon, that’s exactly what could happen.

All it will take is for a longtime owner down the street to sell for an aggressively low price to set a new, devastating comp and change the game for everyone.

What do you think?