Well, this is what you get for fucking around with Wishing Prices, rather than accepting reality and pricing to sell.

As we covered in the previous post, Unit 6 took advantage of Unit 4’s delusional pricing and severely undercut him. And when Unit 6 quickly sold for $335,000, that immediately set a new comp for this condo building. Rather than accepting this incontrovertible fact, Unit 4 continued to insist their place was special and totally immune to market forces and comparable sales.

And now they are in deep shit.

Assuming a buyer comes along and pays full asking price, our seller will eat shit to the tune of $110,000.

They must be absolutely strapped if they are willing to take that kind of loss rather than just hanging on for a few more years. This price means their entire $90,000 down payment is gone AND they’ll have to come out of pocket another $20,000 just to avoid a short sale. This is bad.

And that assumes they can get $349,000, which means an appraiser would have to value this place $14,000 over the last comp. Not bloody likely. And that means the price has to come down even more to close a sale, resulting in an even bigger financial loss.

At this point their best move is probably to just mail the keys back to the bank. Why prolong the pain any longer?

I feel bad for the situation they’re in, but denial is not a plan.

*********PREVIOUS POSTS BELOW*********

WELP.

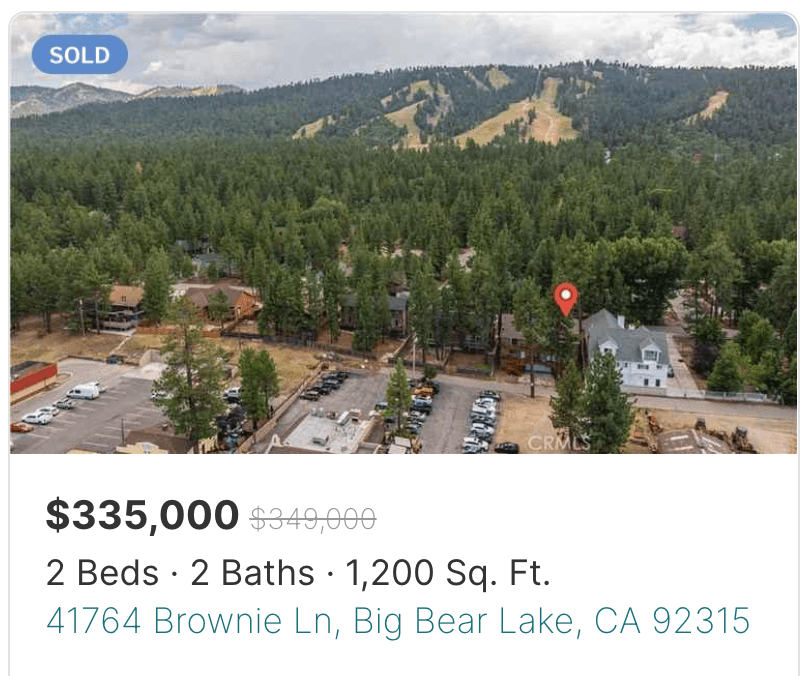

Unit 6 came in with an aggressive price of $349,000 and still had to discount another $14,000 to close the deal. And now the remaining owners in this tiny building have a new, super shitty comp to deal with.

Especially the seller of Unit 4, who is left begging for a suddenly preposterous $399,000. There isn’t an appraiser in the world who would support that price given the new comp priced $65,000 lower.

So now the seller of Unit 4, who (over)paid $449,000 in 2022, needs to choose from one of these crappy options:

- Accept reality and drop the price to $335,000 to get a deal done,

- Keep stubbornly insisting on a ludicrous price no longer supported by recent comps and pray for a miracle,

- Pull the property off the market and re-list when times are better,

- Mail the keys back to the bank.

Each choice has its advantages and disadvantages. Option 1 means they will lose their entire $90,000 down payment and write a $25,000 check on top of that. This is the most expensive option but at least they’ll get it over with.

Option 2 means they will continue struggling to make the monthly payments (the fact that this property is still listed during one of the most difficult real estate environments in recent history is all the proof we need that they can no longer afford it). So death by a thousand cuts, while allowing them to live in denial for a bit longer, doesn’t seem like a viable choice.

Option 3 means they have to count on rates dropping significantly and buyers’ finances improving by spring 2025 (if the seller can stay solvent that long). If the market isn’t better by next year, or there is an even worse comp in the meantime, they would be in an even worse position.

Option 4 is the nuclear option. Sending the keys back and letting the bank foreclose will utterly devastate their credit score and cost them their down payment — but at this point there is no scenario where that isn’t the case. But at least with this option they’ll quickly be done with this nightmare.

All I know is that the seller of Unit 4 seeing this brutal new comp must have felt like a gut punch. Any remaining hope they had must have instantly vanished – they’re upside down by at least $115,000. And now it’s time to get serious and make some hard choices – blind delusion is no longer on the menu.

I wish them the best of luck with whatever they decide.

****************UPDATED POST BELOW****************

I keep trying to warn obstinate sellers: If you sit around waiting for a miracle rather than fixing your price, that gives long-time, equity-rich neighbors the opportunity to undercut you and inflict even more financial pain.

Exhibit A:

https://www.redfin.com/CA/Big-Bear-Lake/41764-Brownie-Ln-92315/home/4112140

Because the seller of Unit 4 refused to budge on price, Unit 6 was able to swoop in with an aggressive price of $349,000 – 50 grand less than Unit 4. Since Unit 6 was purchased in 2008 for just $185,000, they had plenty of room to discount and still guarantee a profit.

That’s a dangerous person to live next to.

To be fair, Unit 4 seems a little nicer with the updated flooring, but it’s not that much different than the much-cheaper Unit 6. And $50,000 can buy a helluva lot of LVT flooring and paint.

Assuming Unit 6 sells for the current asking price of $349,000, that will set a devastating new comp for the entire building. And if that price becomes the going rate for these condos then Unit 4 will suddenly be looking at a loss of $109,500.

So in their stubborn effort to avoid a $70,000 loss, Unit 4 just opened themselves up to a six-figure hit.

****************ORIGINAL POST BELOW****************

Address: 41764 Brownie Ln #4, Big Bear Lake, CA 92315

Zillow: https://www.zillow.com/homedetails/41764-Brownie-Ln-APT-4-Big-Bear-Lake-CA-92315/17618262_zpid/

Beds/baths: 2 bed, 2 bath, 1,200 squares

Purchase Price (5/2022): $449,000

Asking Price: $399,000

Difference: -$50,000

Commission (5%): -$19,950

Total Gain/Loss: -$69,950

In May 2022, our seller paid $449,000 and just two years later is willing to flush $70,000 down the toilet just to get out from under their bad investment.

Seventy.

Thousand.

Dollars.

That is a pretty crappy loss for just two years of ownership.

The sales history is pretty compelling. According to public records, right around the peak of the last housing cycle (September 2007) Seller A paid $200,000 for this place. The Great Recession crashed the party soon after, but Seller A managed to make his tiny $1,500 payment for five years before finally deciding to cut bait.

Unfortunately, Seller A picked the exact bottom of the market and let it go for just $120,000 in October 2012 – an $80,000+ loss.

What’s the investing mantra? Buy high and sell low?

Wait, that doesn’t sound right.

I assume their five years of equity helped to somewhat cushion the blow, but that is still a massive financial hit. I don’t understand why Seller A wouldn’t just keep it rather than eating 80 grand.

Anyhow, in 2012 Seller B got a smoking deal at $120,000 (the 1999 value!) and was living on easy street. However, after eight years the temptation to double his money was too much and in 2020 he offloaded it to Seller C for $255,000.

Although that seems like a decent return for Seller B, if he had just waited 24 months to sell he could have nearly QUADRUPLED his investment. You see, Seller C paid $255,000 in 2020 and thanks to the gains from the pandemic frenzy he was able to sell two years later to Seller D for $449,000 – yielding a profit of nearly $170,000.

Unfortunately, Seller D severely overpaid and is about to go through some shit.

In March of this year Seller D, deep in the bowels of denial, listed for a Washing Price of $489,000 which would have allowed him to cover his sales commissions and walk away with a bit of profit. Delusional and wildly unrealistic.

But he quickly snapped out of it and started cutting the price.

And cutting.

And cutting.

And at 110 days on market, his surefire $70,000 loss seems highly likely to grow. And there are clues that the seller is resistant to losing a penny more than that. Peep this from the listing description:

“Seller related to listing agent.”

Sounds like someone is getting a bro deal on the commissions to help ease the financial pain.

I will say the place looks tidy, albeit pretty drab. The gray vinyl floors were trendy for like 38 seconds but in my opinion they look clinical and lifeless. It’s a ski condo! Don’t be afraid of wood tones!

The two-car garage is undoubtedly a massive win.

Here are what the numbers look like for an interested buyer:

Purchase price: $399,000

Down Payment (20%): $80,000

Monthly Payment: $2,844/mo (@7.4%)

Some might argue that’s a reasonable monthly nut for a two-bedroom condo since the HOA fee typically includes insurance.

But is $399,000 a good value?

Let’s check the Zestimate!

Before we do that, we should note that Zillow likes to claim its Zestimates are based on some highly complex, proprietary algorithm. However, from what I can see they just take whatever listing price the seller comes up with and add or subtract a few percent to make the estimate seem more legit. For better or worse, a lot of sellers and buyers rely on Zestimates to determine a property’s true market value.

Side note: Jim the Realtor at bubbleinfo.com covers the Zestimate nonsense really well. He is one of the best in the business and was one of the inspirations for this blog.

My point is that although the vast majority of Zestimates are wildly optimistic, even Zillow isn’t hopeful about this place:

$385,000?! OUCH!

If that estimate is anywhere close to market value our seller is guaranteed to incur an $83,000 loss. That’s pretty much their entire 20% down payment, meaning this property is at serious risk of becoming a short sale if they can’t find a buyer soon.

And look at this graph line:

Do you think that’s going to suddenly stop plummeting in the next six months? I sure don’t.

And yet our seller is sitting idly by wishing for a miracle.

You know what they say: “Wish in one hand and shit in the other, and see which one fills up first.”

Look, I will always root for people who are willing to admit they made a mistake rather than insisting on living in fantasyland. So the multiple price cuts should be commended. But is $399,000 enough to snag a buyer?

Maybe, just as long as that buyer doesn’t have access to Zillow.

Please let me know in the comments what you think.

What do you think?