Another useless price cut.

Good for them for finally doing something – remember, there wasn’t a single price cut between June and October. So three cuts in November alone is commendable. But these chickenshit price cuts are not going to…cut it.

It’s been listed for more than 160 days with no love. But at $326 per square foot, they might be getting closer to attracting a buyer. At least, that’s what they’re desperately hoping for.

A sale at today’s asking price would mean a loss of nearly $100,000, and that loss grows with every price reduction. I bet they regret not pricing more aggressively five months ago as I suggested, but here we are.

***********PREVIOUS POSTS BELOW***********

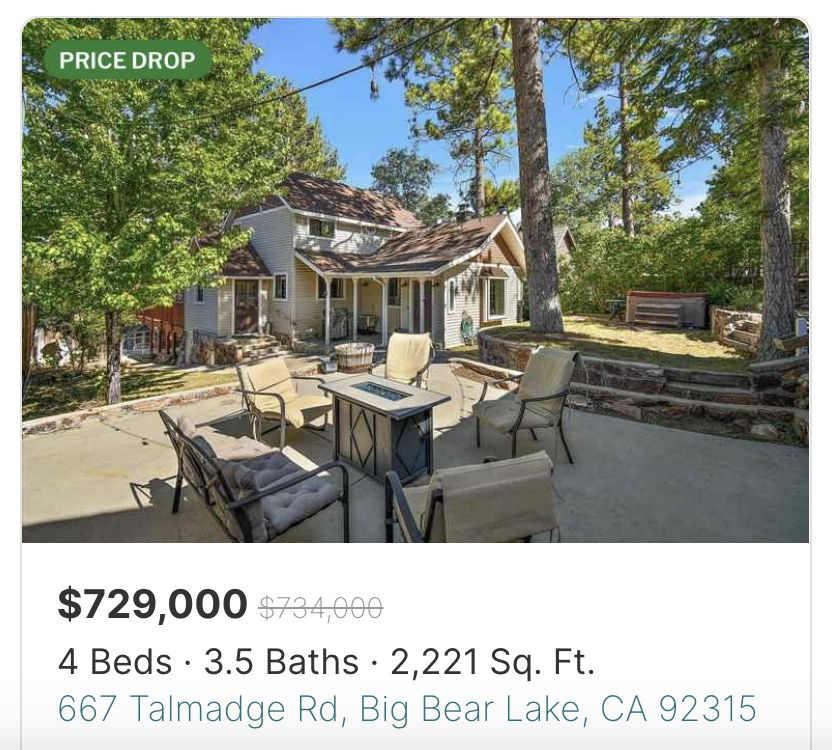

Things are not looking good for our sellers.

They listed in June for $799,000 and have been chasing the market down ever since. After five price cuts they are currently begging for $729,000, representing a $93,000 loss after commissions.

It’s still possible to salvage some of their $160,000 down payment, but rates are on the rise again and Big Bear prices are under a lot of pressure. I don’t think our seller is in any danger of losing their entire down payment (that would mean a sales price of like $660,000 – this place will get snapped up long before the price gets that low) but they need to get with the program quickly if they want to minimize their already substantial losses.

***********PREVIOUS POSTS BELOW***********

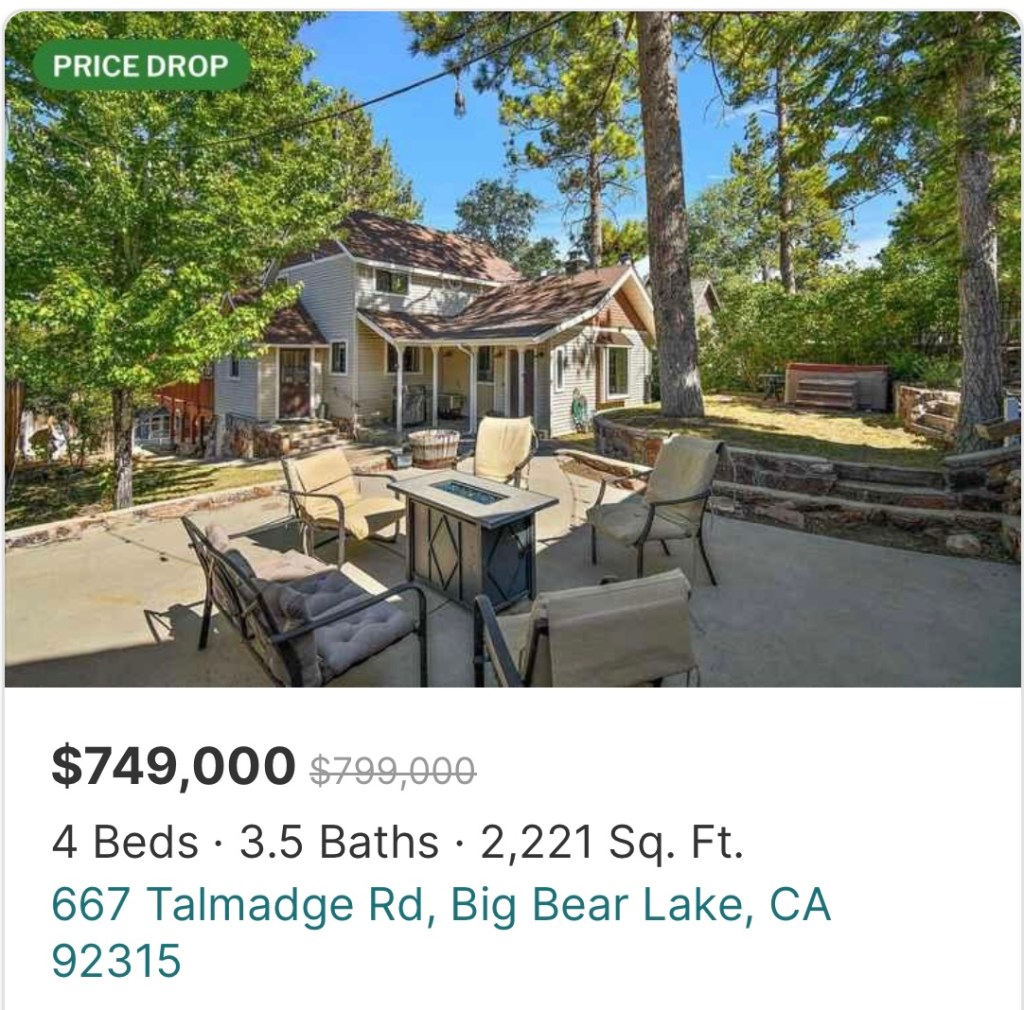

After 100 days on the market, they finally made a move. But is this $50,000 reduction too little, too late?

If you recall, they listed in June 2024 for just $1,000 less than they paid in May 2022. Then, after spending more than three months necrotizing on the market they finally reduced the price to what it should have been from the outset.

Abandoning their childish pricing strategy means if it actually sells for $749,000 they will sacrifice $75,000 of their down payment to the Price Discovery gods.

You might be wondering: Rather than taking that kind of horrendous financial beating, why not just hang on to the property?

Because they can’t.

It’s obvious they can no longer afford the carrying costs – why else would they try to sell during such a horrific real estate environment for 2022 and 2023 buyers? If they had the financial means to ride it out, they would have delisted long ago.

Anyhow, given how long they stuck to their delusional guns, I’m kind of shocked they dropped the price so dramatically. Hopefully this cut is enough to get the job done, but there is no telling how much momentum they lost by insisting on a ridiculous, denial-driven price during the entirety of the Super Summer Selling SeasonTM.

**************ORIGINAL POST BELOW**************

Address: 667 Talmadge Rd, Big Bear Lake, CA 92315

Link: https://www.redfin.com/CA/Big-Bear-Lake/667-Talmadge-Rd-92315/home/3503775

Beds/Baths: 4 bed, 3.5 bath, 2,221 squares

Purchase Price (5/2022): $800,000

Asking Price: $799,000

Difference: -$1,000 (LOL)

Commission (5%): -$39,950

Total Loss: -$40,950

The sales history is a great demonstration of how AirBnB and cheap mortgages fueled the real estate frenzy in Big Bear.

In February 2015, Buyer A unloaded this place to Buyer B for $350,000. With 2,000+ square feet that sounds like a good deal for Buyer B.

Five years later in October 2020, in the early innings of the pandemic craze, Buyer C coughed up $535,000. That allowed Buyer B to walk away with $158,000 in profit – a solid 7.8 percent in annual appreciation.

In May 2022 – mere months after the Fed started hiking rates – Buyer C managed to pass it to Buyer D for an astounding $800,000 (nearly 30 percent appreciation per year for Buyer C)!

I don’t know if Buyer C is an absolute genius or just got extremely lucky, but holy crap did he ever play this perfectly. Thanks to his impeccable timing he strolled away with +$225,000 in cash for just 1.5 years of ownership.

Unfortunately, Buyer D got screwed on this whole deal.

Instead of being able to walk away with big winnings like his predecessors, Buyer D got stuck holding the bag. It stinks, but that’s how it goes when speculative bubbles pop: somebody inevitably ends up with the hot potato.

On June 21, 2024, he listed with an asking price of $799,000 – exactly $1,000 less than he paid in 2022. That price conveniently limits their losses to just sales commissions, roughly $40,000, and nothing more.

But something about that $1,000 “discount” from their purchase price reeks of a petulant child who refuses to admit the game is over and they lost.

Although most Big Bear properties are selling for 2021 prices these days, I have actually seen a few high-quality, dialed-in homes transacting at 2022+ prices. So maybe the pricing is on point and this is one of those special properties?

Let’s investigate!

Welcome to the Taj Mehhhh-hal. The kitchen and primary bedroom seem fine, but everything else looks kind of tired.

By the way, do they know Amazon sells cord concealers for like $13?

And although the peek-a-boo lake view is cool, is it really worth $800,000?

Oh, sorry, $799,000.

Considering that a new buyer’s monthly payment would be $5,500 after a $160,000 down payment, this seller is out of their mind if they think their price is competitive. That is a monster financial commitment for such a mediocre property.

I would ask what comps the seller is looking at to justify this asking price, but it’s clear the pricing is solely based on a desire to avoid admitting they made an expensive mistake. Psychologically it’s much easier to convince themselves that “transaction fees” aren’t technically a loss and therefore as long as it sells for what they paid they’re still “winning.”

Someone with this denial-driven mentality is highly unlikely to reduce the price any more than their extremely generous $1,000 discount because that would mean losing part of their down payment (or all of it if they wait too long to pull the trigger). And that is simply unacceptable!

I expect this one to sit for a long time.

What do you think?