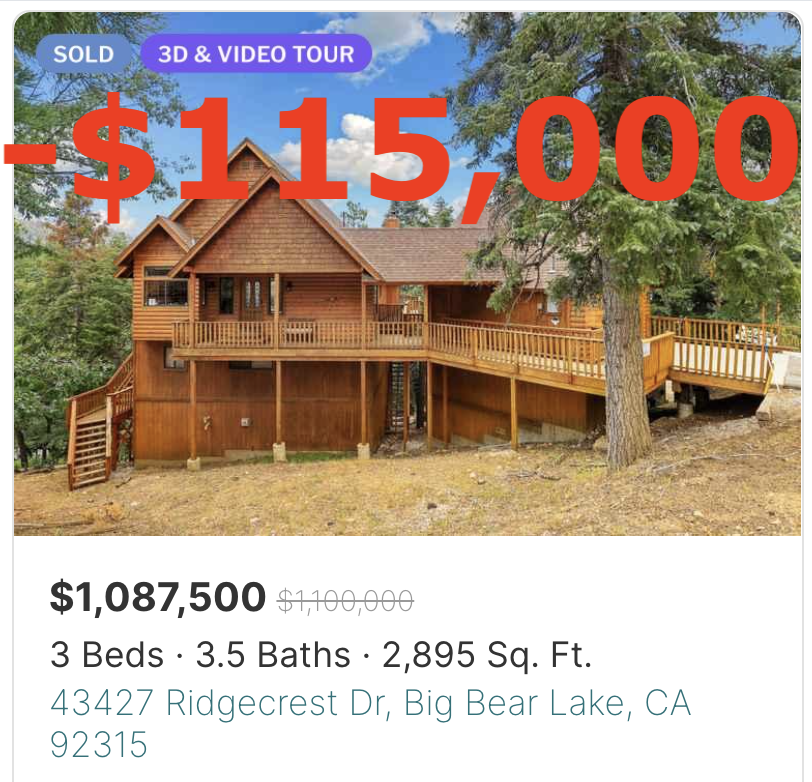

Purchase Price (12/2021): $1,169,900

Asking Price: $1,087,500

Difference: -$82,400

Commission (3%): -$32,625

Total Loss: -$115,025

While most Big Bear “investors” who purchased in 2021 are getting out at break even or even with a tiny amount of profit, this seller wasn’t so lucky.

They initially tried to get $1,199,999 to cover Redfin’s cut, but it didn’t take long for them to realize buyers at that price simply didn’t exist. After a series of price reductions they were asking $1,100,000 in October, and they ultimately accepted an offer of $1,087,000 to get the deal done.

The cost of their Genius Real Estate Investor cosplay?

$115,000 after commissions.

An expensive lesson in irrational exuberance.

*************PREVIOUS POST BELOW*************

Address: 43427 Ridgecrest Dr, Big Bear Lake, CA 92315

Link: https://www.redfin.com/CA/Big-Bear-Lake/43427-Ridge-Crest-Dr-92315/home/3511949

Beds/Baths: 3 beds, 3.5 bath, 2,895 squares

Purchase Price (12/2021): $1,169,900

Asking Price: $1,149,000

Difference: -$20,900

Commission (3%): -$34,470

Total Loss: -$55,370

In December 2021, around the height of the pandemic-era frenzy, our seller paid an eye-popping $1,169,900 for this big bomber. Less than two years later they pulled the ejector seat and listed for a Washing Price of $1,199,999.

Knowing that price wouldn’t quite cover sales commissions, they wisely (?) listed it with Redfin to cut down on closing costs.

Every penny counts!

Unfortunately, their dreams of breaking even were dead on arrival, and after a few price cuts and a re-list they are down to a money-losing price of $1,149,000. Assuming they find a buyer to pay full boat – which is a big assumption – their little foray into the “luxury mountain retreat” lifestyle will cost them about $55,000.

The property itself is…fine? I don’t know that this looks like a $1,149,000 cabin, but maybe rich people have different tastes than I do?

And what it going on with that wonky antler lamp? You couldn’t take the three seconds to fix that before listing your house for OVER A MILLION DOLLARS?

Time is money!

They could have spent $100 and a weekend painting the kitchen and bathrooms a neutral color, but that would just add to their losses. So why bother?

Money doesn’t grow on trees!

Just look at this monster payment:

Purchase price: $1,149,000

Down Payment (20%): $230,000

Monthly Payment: $7,805/mo (@7.3%)

Yikes! And for that kind of cash it doesn’t even have a hot tub.

Obviously, buyers in this price range have plenty of down payment cash and can easily handle the $8,000 monthly nut. But is this ho-hum property actually worth $8,000 a month?

Considering they have been listed since August 2023 with no luck (happy one-year anniversary, dude!), it’s clear that even well-heeled buyers don’t see the value here.

Frankly I’m not sure why I bothered featuring this property. The seller is clearly not interested in selling for market value because that would mean an even bigger loss than the $55,000 hit they’re already facing. I sympathize with their predicament and understand their reluctance to reduce the price, but it’s been a month since the last price cut. This seems like a waste of everyone’s time.

So they’ll probably pull the listing in a few months, rent it out for big bucks during the winter season, then re-list in Spring with the hopes that lower mortgage rates will make their asking price seem more palatable.

But what if rates are even higher in 2025? What if there are some gnarly comps in the meantime? What if the unemployment rate is higher?

As we saw with Code Brown, in this selling environment it doesn’t pay to delay.

What do you think?