Address: 1144 Sheephorn Rd, Big Bear Lake, CA 92315

Link: https://www.redfin.com/CA/Big-Bear-Lake/1144-Sheephorn-Rd-92315/home/4118113

Beds/Baths: 3 bed, 2 bath, 1,095 squares

Purchase Price (6/2022): $566,000

Asking Price: $549,000

Difference: -$17,000

Commission (3%): -$16,470

Total Loss: -$33,470

Short sales are incredibly rare in Big Bear, so this listing immediately stood out.

For those of you who don’t know about short sales, here is a brief definition:

A real estate transaction where a homeowner sells their property for less than the remaining balance on their mortgage. The term “short sale” refers to the fact that the sale proceeds will be less than the amount owed on the mortgage.

Basically, you forfeit your entire down payment to the lender, and the lender agrees to forgive the difference between what you still owe (higher number) and the sales price (lower number). Once the house sells you are released from your mortgage obligation. Your credit score will take a hit and you might get hit with the tax bill for the forgiven amount, but it’s a lot better than a foreclosure on your record.

So you might be wondering how this property can be a short sale when there’s only a $17,000 difference between the asking price and the purchase price. Seems like the buyer would only have to give up a portion of their down payment to walk away relatively unscathed.

But digging a bit deeper reveals a second mortgage taken out 16 months after purchase. Who knows what they did with that money (a pair of jetskis? Down payment on a G-Wagen?), but the result is a total mortgage obligation of $585,337.

But that still doesn’t explain why it’s a short sale. The difference between $585,337 (both mortgages combined) and the asking price ($549,000) is only like $26,000, which is still a fraction of a 20-percent down payment.

Ah, but that assumes the seller put down 20 percent. Eagle-eyed readers might have noticed those three little letters in the mortgage history:

F H A.

Since Federal Housing Administration loans are backed by taxpayers, they are notorious for requiring tiny down payments (as low as 3.5 percent with a 580 credit score).

If we assume this seller only put 3.5% down in 2022, that’s only $19,810. So you can finally see why this is a short sale: The seller had no skin in the game, and with their $20,000 down payment already gone they are hitting the road and making it the bank’s problem. I mean, why throw more good money after bad?

So now the lender is trying to mitigate their losses with a wildly optimistic asking price of $549,000. The trouble is this place is not exactly a stunner:

And then there are useless photos like this. To all sellers: just stop with the “artistic” shots and show us relevant pics.

Anyhow, here’s where it gets funny:

“THIS UNIQUE CABIN HAS BEEN A VERY SUCCESSFUL VACATION RENTAL MAKING OVER $50,000/YEAR (even with the owners use) AND IT WOULD ALSO MAKE A GREAT FULL-TIME OR PART-TIME HOME.”

It couldn’t have been that successful if the seller is willing to light their down payment on fire and walk away after just 2.5 years. If this property was such a golden goose, why wouldn’t they just hang on to it and keep stacking up that short-term rental cash?

Because it utterly failed as a vacation rental.

$50,000 gross income doesn’t mean shit if the mortgage, taxes, insurance, cleaning costs, property management fees and repairs eat up all that money you “made.”

So these losers couldn’t make it work, but expect you to believe your financial dreams will come true at a similar purchase price with a much higher interest rate.

Get the fuck out of here.

Furthermore, the whole “very successful vacation rental” thing is strange because there’s no way this staircase ever passed city inspection. I don’t understand how they got a rental license with this death trap, but I guess we’ll just have to take their word for it.

Are you interested in catching a falling knife? Here’s what you’re looking at:

Purchase price: $549,000

Down payment: $109,800

Monthly nut: $3,640/mo (@7%)

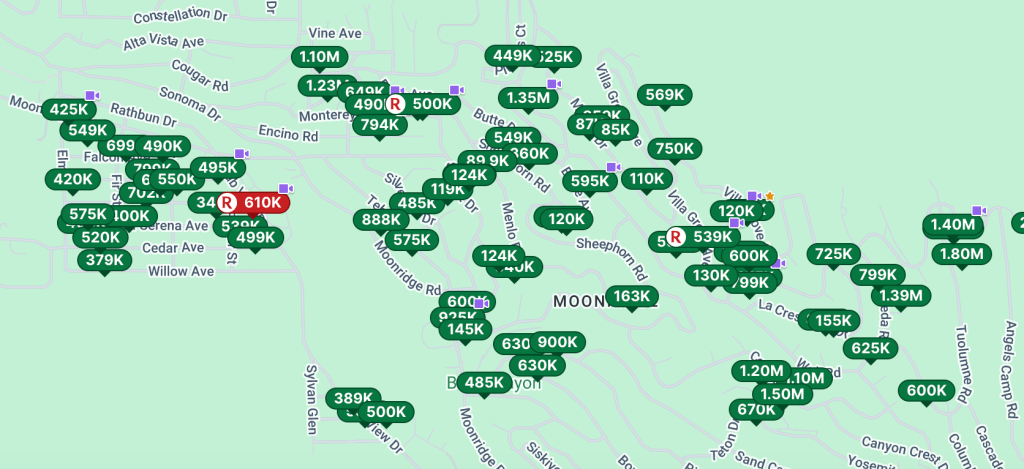

Seems pretty steep considering the so-so condition. Not to mention the insane amount of competition in Moonridge:

My first home purchase in 2012 was a short sale, and although it was a long, laborious process the end result was great. The bank accepted my ridiculous lowball offer (it was every dollar I had) and the previous owners got to walk away without a foreclosure on their credit score (good thing they leased a new BMW 5-series beforehand).

But in my case I got a $230,000 discount from the 2007 price, which made the downside risk of further price corrections more than worth it. But this property is only offering a measly $17,000 discount with tons of economic headwinds on the horizon (not to mention exorbitant insurance costs for buyers).

That means the bank is going to need to part with a lot more than a piddly 17 grand if they hope to lure a buyer.

What do you think?