So, if most 2021 buyers are breaking even…

And most 2022 buyers are giving up big chunks of their down payment…

And most 2023 buyers are losing their ass…

What the hell does that mean for people who bought in 2024?

We’re about to find out!

Link: https://www.zillow.com/homedetails/714-Elysian-Blvd-Big-Bear-City-CA-92314/17391773_zpid/

Beds/Baths: 1 bed, 1 bath, 608 squares

Purchase Price (6/2024): $282,000

Asking Price: $279,999

Difference: -$2,001

Commission (3%): -$10,401

Total Loss: -$33,470

These poor suckers paid $282,000, which must have felt like a bargain compared to the seller’s initial demand of $349,500.

With a big discount like that, surely they’d be fine if they had to sell in a few years, right?

Well, life happens and those “years” quickly turned into months. Yep, just six months after purchasing they hit financial hard times and had no choice but to sell for a loss.

Of course, that “loss” is a measly $2,001. I hate the be the bearer of bad news, but it’s going to take a helluva lot bigger sacrifice than that to attract a buyer.

Because at the end of the day, this is a microscopic one-bedroom, one-bath cabin way out by the airport. Sure, it’s is pretty nice inside, but that’s like having the nicest ’04 Kia Sorrento for sale on Craigslist. It’s still a used Sorrento.

And with just one bedroom, this is basically useless as a short-term rental. Your clientele is primarily limited to couples and solo travelers looking for a place to write their manifesto. So these sellers are looking for a buyer who doesn’t like skiing and can afford a $2,000 payment without needing to supplement with Airbnb money.

How many buyers like that exist?

Sure, $2,000 is a reasonable payment for a second home in Big Bear, but it starts to look pretty steep when you consider how far out in the boonies this property is.

Yikes!

Big Barely, amirite?

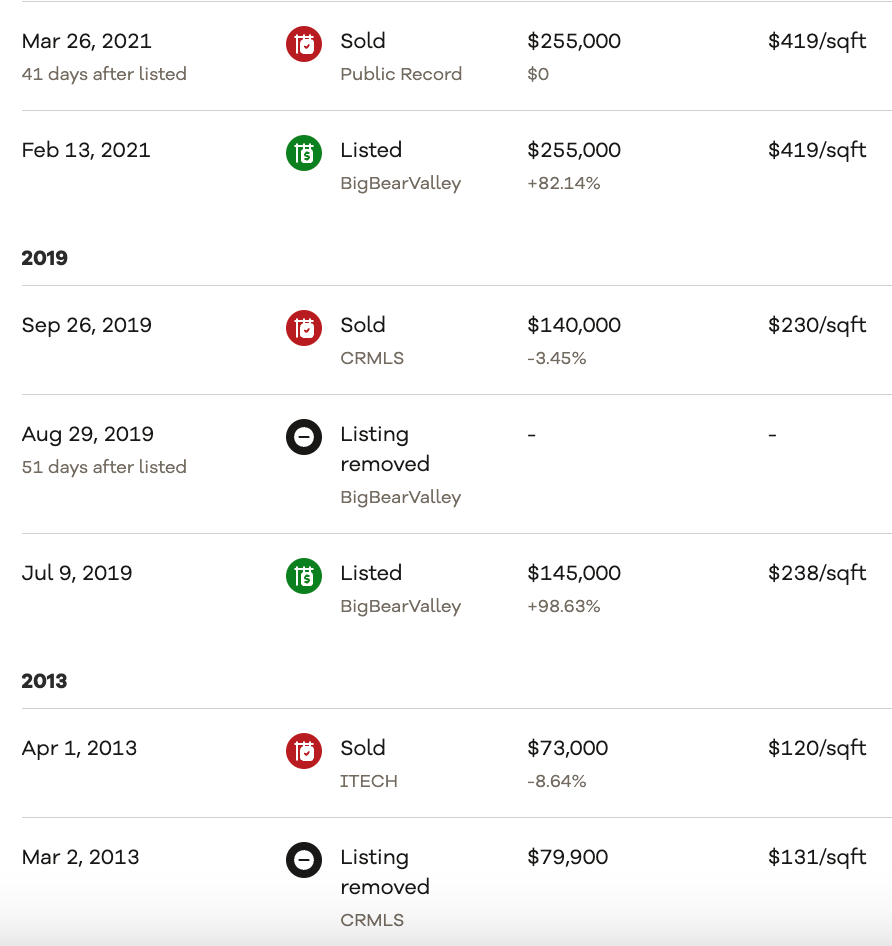

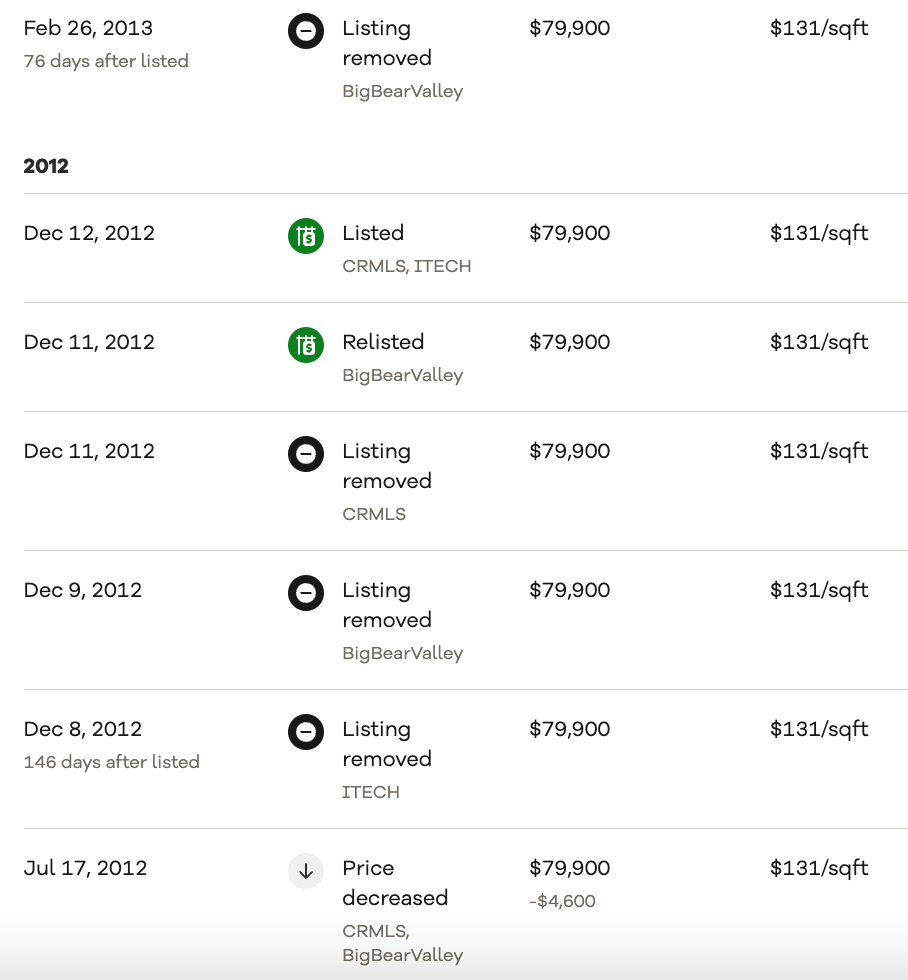

The listing history is kind of insane:

The early years of this property especially caught my eye. Look at the level of appreciation for three decades starting in the 1980s. It basically went up a few percent a year, indicating of a normal, healthy real estate market.

But between 2013 and 2019 it went ham, and between 2019 and 2021 it went absolutely bonkers. Sure, some modest improvements were made to the property at some point along the way, but there’s no way this thing is worth $270,999 today with 7% interest rates – upgrades notwithstanding.

I believe when this correction is all said and done these microscopic cabins out in the hinterlands will be valued at basically the cash price. Nobody in their right mind is going to get a mortgage on places like this if it means being forced to shell out $5,000 or $6,000 a year for insurance, especially if they’re unable to make extra money with VRBO rentals. That means the true value has to be a fraction of the current asking price.

I would be shocked if this seller got the 2019 price of $140,000. Obviously if the value drops that low then they’ll just mail the keys to the lender. They only put down $56,400, so if they had to drop the price to, say, $225,000, all of their down payment money instantly vanishes. And at that point do you really think they’ll keep lowering the price only to write a check to the lender at closing?

Not.

Bloody.

Likely.

They’ll just walk away and make it the bank’s problem.

Look, the sad fact is they overpaid for a clean cabin in an undesirable location, and it’s going to cost them dearly. Getting $279,000 is a pipe dream and they are wasting valuable time insisting on such a stupid price.

This price needs to start with a one, pronto. We know it will go back to bank long before that happens, but that’s the reality of this situation.

What do you think?