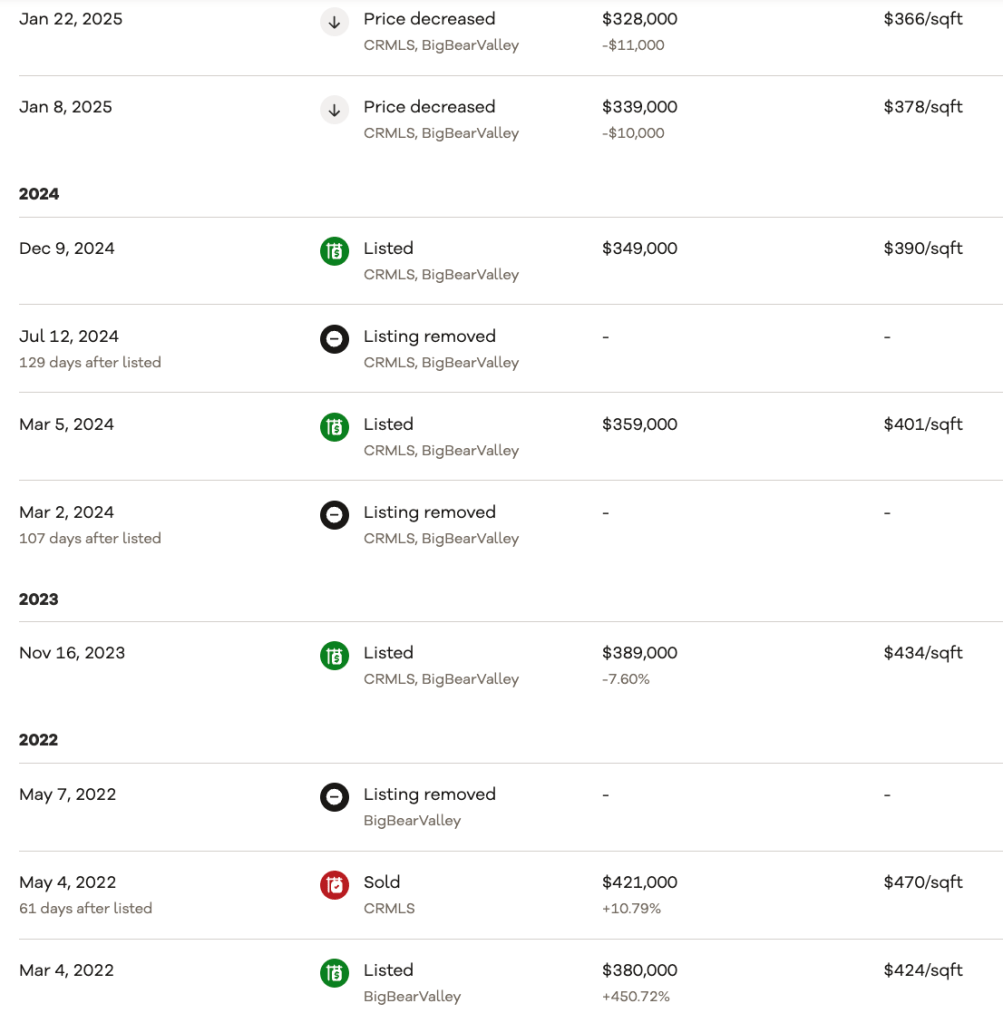

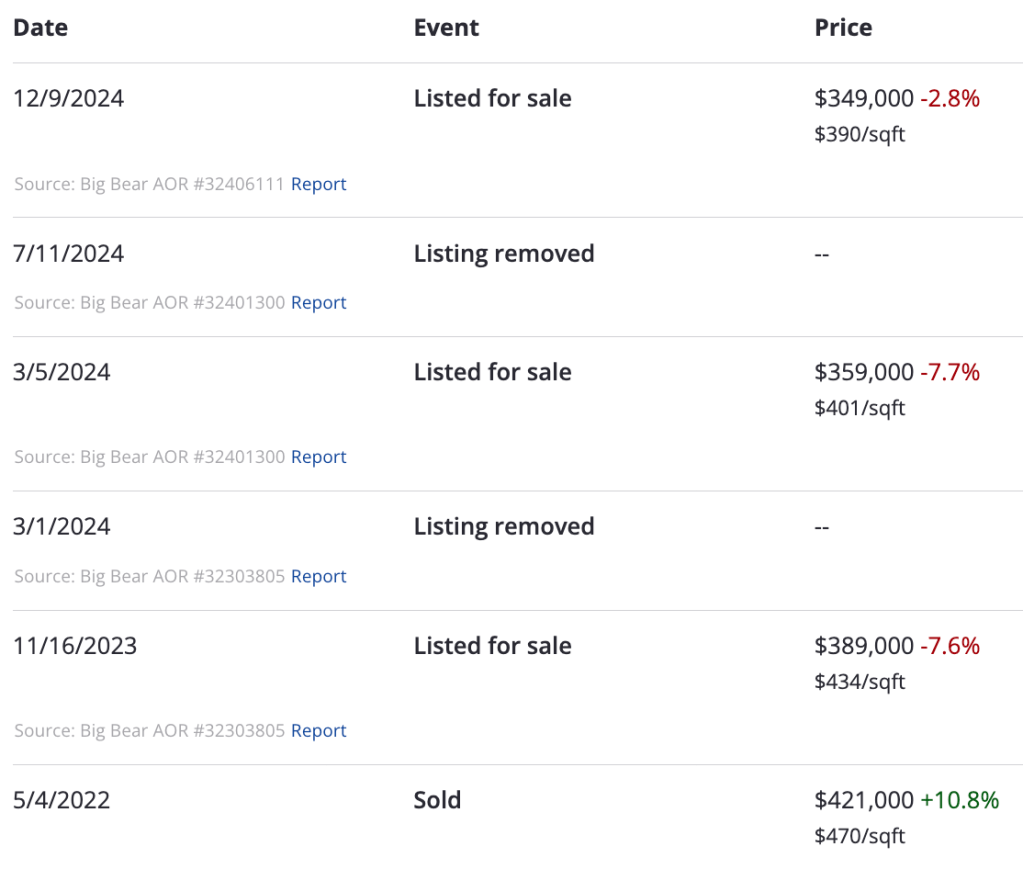

With their down payment already vaporized, I cannot for the life of me understand why they haven’t walked away yet. Assuming this latest price cut finally attracts a buyer (doubtful), their total loss will be $102,000.

That figure includes their entire $84,000 down payment, plus a personal check for $18,000 on top of that. It makes no sense – at the very least this should be a short sale.

Their depressing journey highlights the importance of not overpaying during a speculative frenzy. I bet they regret getting in a bidding war and paying $41,000 over ask in 2022.

My advice: Mail the keys to the bank and tell them you’re done. Sure, a foreclosure on your credit will sting for a while, but at least you’ll finally be able to move on from this calamitous mistake.

*********PREVIOUS POST BELOW*********

Address: 1036 Robinhood Blvd, Big Bear City, CA 92314

Link: https://www.redfin.com/CA/Big-Bear-City/1036-Robinhood-Blvd-92314/home/3514308

Beds/Baths: 2 bed, 1 bath, 896 squares

Purchase Price (5/2022): $421,000

Asking Price: $349,000

Difference: -$72,000

Commission (5%): -$10,470

Total Loss: -$82,470

These people know they’re fucked.

They originally listed for $389,000 in November 2023, just a year-and-a-half after purchasing. Considering they (over)paid $421,000 for this place, they acknowledged from the outset that a sale would cost them $30,000 plus commissions.

Pretty crappy, but could be worse.

Unfortunately, the market had other ideas and decided the pain would be much more severe than a measly 30 grand. After a series of re-lists and price reductions, the current asking price of $349,000 represents a stunning loss of $82,000. That is their entire down payment, gone like a sparrow fart in the wind.

And that, as always, assumes the buying public believes this is a good price. Let’s crunch the numbers:

Purchase price: $349,000

Down payment: $69,800

Monthly nut: $2,371/mo (@7.3%)

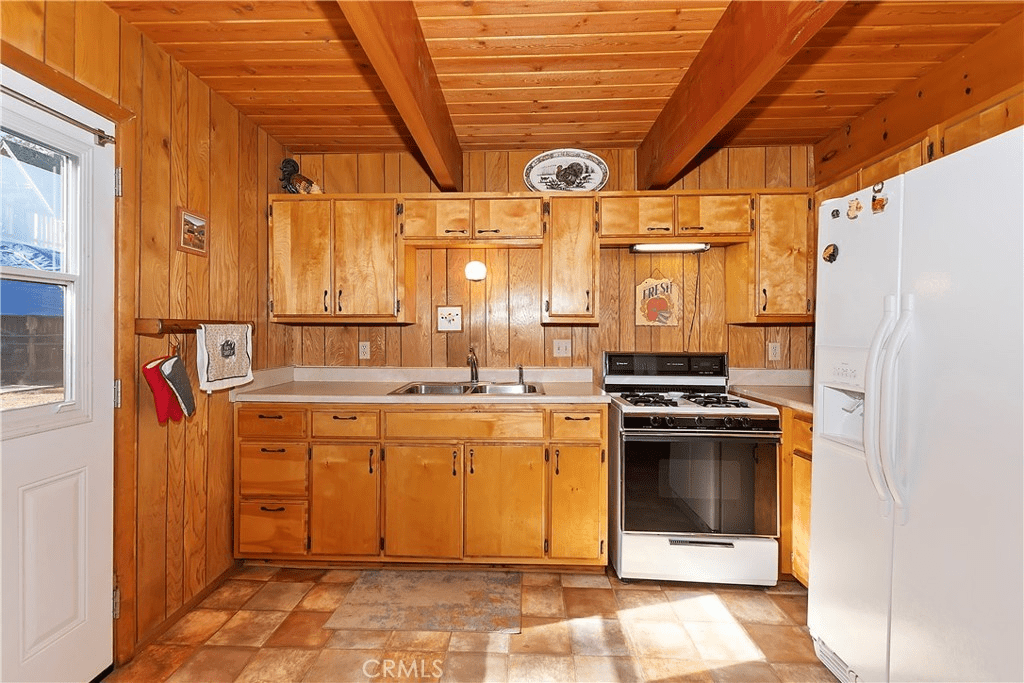

That’s a pretty penny for 900 square feet. And those square feet are pretty rough:

Look, I wish them the best, but with their down payment already incinerated they must be at least considering mailing the keys back. Any further price reductions and they’re going to have to come out of pocket to avoid a short sale.

Remember this property on the same street? Well that guy didn’t have the stones to stick around and find out true market value – he pulled it off the market on December 5. But he was only staring down the barrel of a $46,000 loss.

Our seller is in a much more desperate situation and simply taking his ball and going home is not an option. He needs to face the music, and needs to choose which tune he’s going to dance to:

- Jingle Mail

- The Short Sale Shuffle

- Oh Fuck, I Need to Pay Tens of Thousands on Top of Losing My Entire Down Payment to Free Myself of This Grave Financial Mistake Without Destroying My Credit (Radio Edit)

Not a lot of great options, but that’s just how it is for most 2022 buyers.

What do you think?