Address: 334 Jeffries Rd, Big Bear Lake, CA 92315

Redfin: https://www.redfin.com/CA/Big-Bear-Lake/334-Jeffries-Rd-92315/home/3058652

Beds/Baths: 1 bed, 2 bath, 1,270 squares

Purchase Price (3/2022): $660,000

Asking Price: $670,000

Difference: +$10,000

Commission: -$33,500

Total Loss: -$23,500

The most important thing you need to know is that it’s not a typo: This place, demanding a princely sum of $670,000 clams, has only one bedroom.

One.

I hope the new buyer doesn’t have kids, or friends, or extended family (or any common sense whatsoever). And even if the buyer wants to host guests, one look at that little trundle bed tells me you also don’t have a need for privacy either. This is wild.

But you might say, “Big Bearish, there is some weird room in the listing photos that for some odd reason was not mentioned in the listing description – you could just put a few sleeping bags in there and host more people!” Um, sure. Go for it. Put your kids in there for the night.

Or you might suggest converting the garage into a living space. Good luck with that, chief:

I have to say the main house looks pretty tidy. Although I can’t stop laughing at the ENORMOUS fridge taking up a third of the kitchen.

And the bathrooms have been nicely updated.

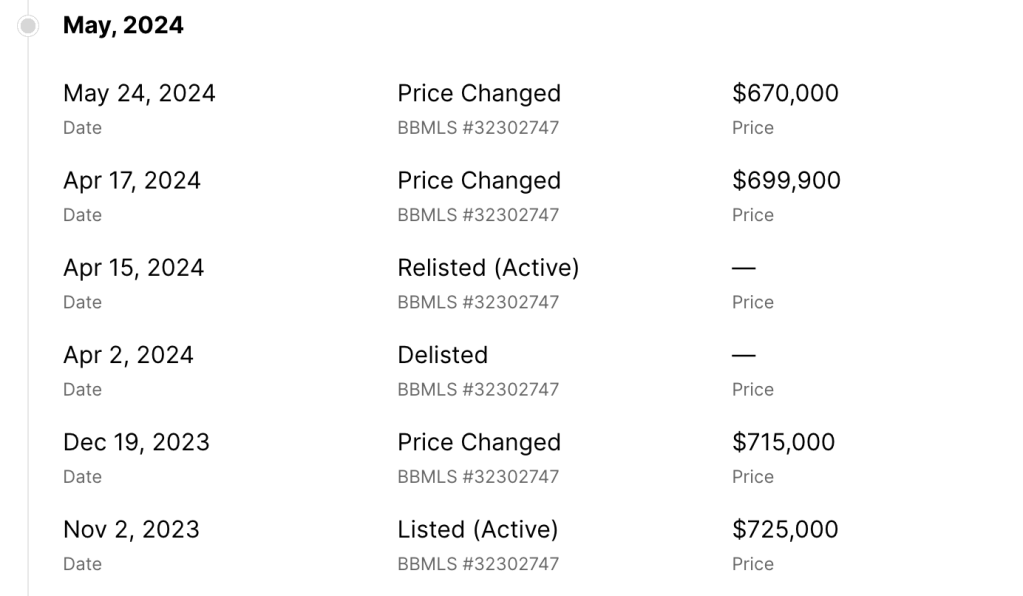

In June 2023, just 15 months after they purchased, they listed it for sale with an insane asking price of $790,000. That certified Wishing Price would miraculously allow them to walk away with a fat profit after Realtor commissions. As if interest rates hadn’t doubled since they bought.

In November 2023 they relisted at $725,000, which still would have ensured a tiny profit. By April 2024 they were trying to get a Washing Price of $699,900 which ended any hopes of a profit but would have allowed them to escape with no financial loss whatsoever (get it, a wash?), and now here we sit at $670,000 which locks in a loss of $23,500.

I’m sure they told their listing agent that they simply can’t afford to reduce the price any further.

And so they sit.

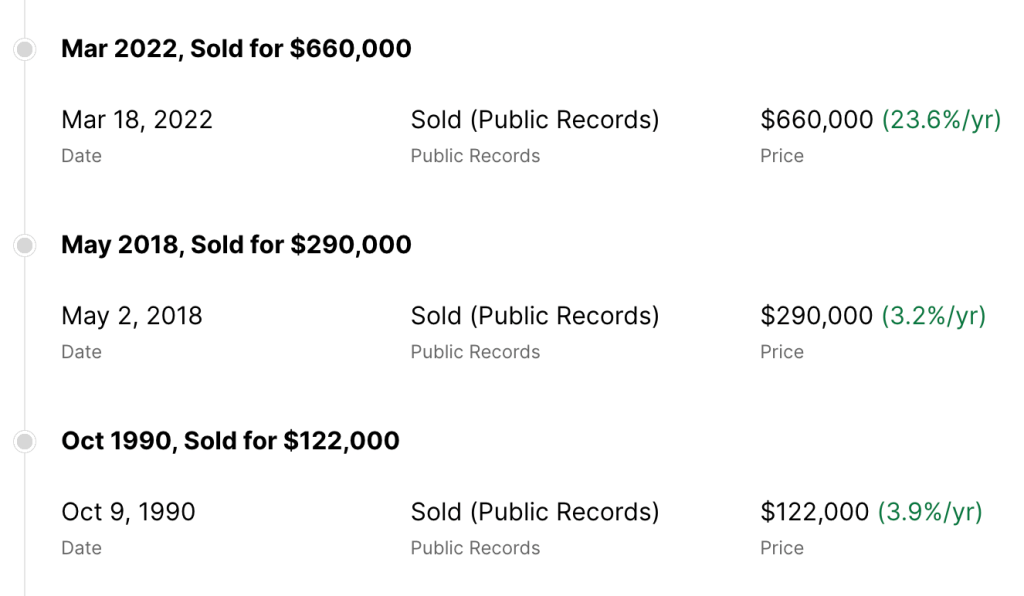

As an aside, it’s wild to look at the insanity of Big Bear real estate values over the years. It took 28 years, from 1990 until 2018, for this property to double in value, then in just four years between 2018 and 2022 it more than doubled again.

This clearly demonstrates how the cheap, easy money of the pandemic years caused so much distortion in this market.

Back to this property. This part from the listing description stood out:

“This home also is meticulously prepared to be an Airbnb-ready, ensuring a seamless and inviting experience for your guests should you find yourself inclined to explore the possibility of hosting short-term rentals.”

That’s good news because I don’t see how this would make sense as a purchase unless you used it as a short-term rental. If you don’t happen to have $670,000 burning a hole in your savings to pay cash for this place, you would absolutely have to rent it out to make it work.

But with just one bedroom I don’t see how this property is marketable as an AirBnB. Again, unless you want your children to sleep in that blue-carpeted nightmare that may or may not be properly insulated/heated/cooled/sealed off from bugs and rats.

Furthermore, if this property presents such a great opportunity for a short-term rental, why isn’t the seller sticking with that and cashing in on all that easy loot? Answer: Because this place is not attractive as a rental, can’t possibly earn enough to cover the mortgage, and they hope you’re too stupid to realize it.

And then there’s this:

“This lot is zoned as R3, presenting exciting prospects for either incorporating two more units or exploring the option of transforming the current structure into an expansive 3-bedroom dwelling. The owner has already prepared detailed plans, providing a valuable reference for your consideration.”

If adding more units or demolishing and replacing the existing structures was such a great recipe for success, why didn’t they do it? They already have the building plans for such an “exciting prospect” – why not go for it, homey?

We all know why.

This thing was a bad investment at the $660,000 they paid, and now they expect you shell out even more than they did to protect them from the consequences – never mind that the numbers today are so much worse than when they bought in 2022.

Feast your eyes:

Purchase price: $670,000

Down Payment (20%): $134,000

Monthly Payment: 4,622 (@7.5%)

That’s a big chunk of change for only one bedroom!

To put that payment in perspective, you would need to earn roughly $150,000 per year to afford this property. With two earners that seems reasonable, but that 36% debt-to-income ratio assumes you have no other debt. No car payments, no credit card debt, no student loans, no nothin’.

And if you have the income to afford this payment it also means you don’t have a primary residence or pay rent elsewhere – this would have to be your primary home. Which of course means you and your partner must have remote jobs, because there aren’t many gigs in Big Bear paying $150,000 – or even $75,000 each for a two-income household. Working at the Bowling Barn ain’t gonna pay that kind of scratch.

And if you’re looking at such a pricey one-bedroom home as your primary residence it’s highly unlikely that you have kids. That’s good because the schools in Big Bear are not great.

Realistically, we all know this house isn’t for someone planning to live in Big Bear full time. And it also isn’t for someone looking for a weekend vacation home – it’s just too expensive to leave unoccupied for that long.

So the next buyer must put it on AirBnB to help offset that considerable monthly nut. But now we’re back to the original problem: there’s only one bedroom.

Based on all of this, this seller is smoking some muy grande crack rocks if they think a buyer is going to pay anywhere close to what they paid at the height of the 2022 easy-money frenzy, let alone more than what they paid!

If they truly want to get rid of this grave financial mistake, the first digit of their asking price needs to be a 5 right now. But if they dropped the price to $599,000 tomorrow, their entire down payment of $132,000 would instantly vaporize. That’s a tough pill to swallow, and the reason we are in this stalemate.

So this seller, like so many other pre-pandemic buyers, will rot on the market waiting for that one miracle buyer with more money than sense to come along and save them. The only problem is that hundreds of other Big Bear listings clogging up the MLS are also competing for that same cashed-up moron to bail them out, and those sellers have the distinct advantage of offering more than one bedroom.

What if $550,000 is the number that finally attracts a buyer? That means on top of losing their entire down payment of $132,000, this seller needs to write a $50,000 check to get free. And when faced with that unpalatable choice, they might decide it’s not worth it and hand the keys back to the bank.

And if that happens en masse, look out below.

Leave a reply to Anonymous Cancel reply