Address: 43103 Grizzly Rd, Big Bear Lake, CA 92315

Link: https://www.redfin.com/CA/Big-Bear-Lake/43103-Grizzly-Rd-92315/home/4117903

Beds/Baths: 2 bed, 1 bath, 789 squares

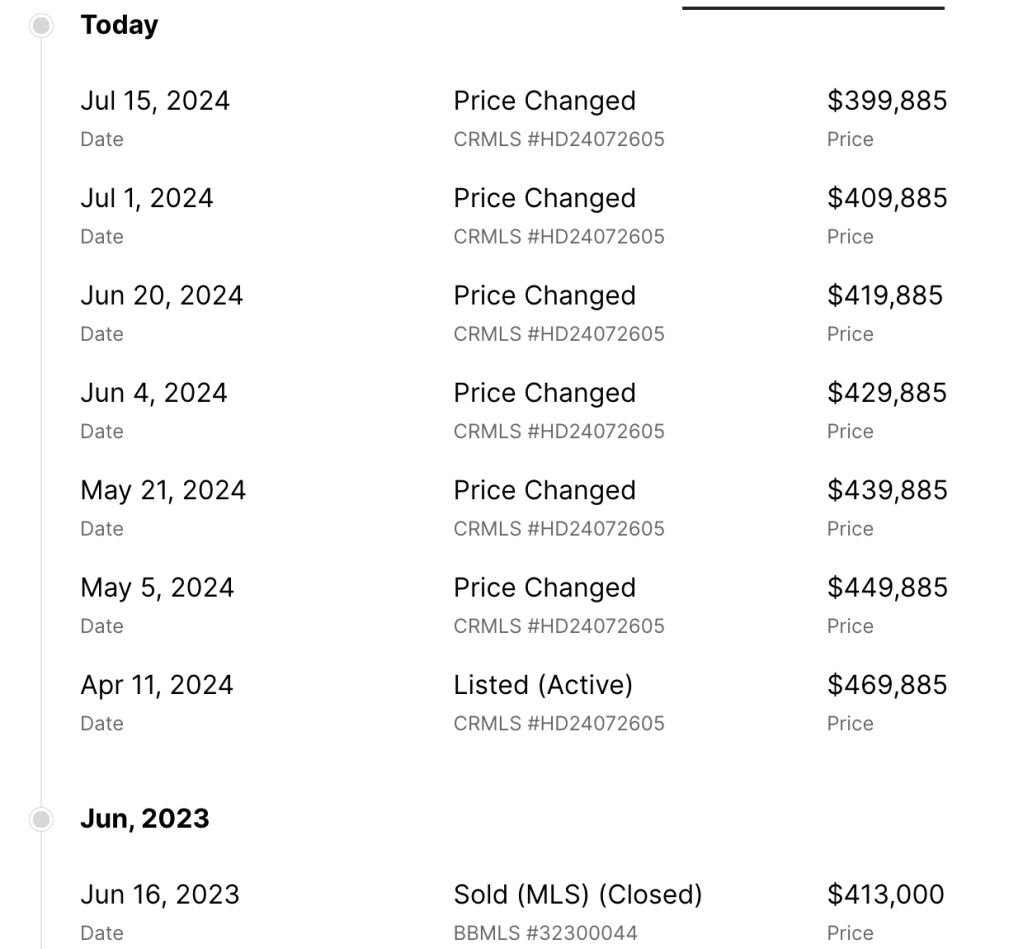

Purchase Price (6/2023): $413,000

Asking Price: $399,885

Difference: -$13,115

Commission (5%): -$19,994

Total Loss: -$33,109

This purchase timing is about as bad as it gets.

Our seller purchased in June 2023 (ouch) for $413,000 (double ouch) and just 10 months later put it on the market with a Wishing Price of $469,885. After a series of penny-ante price cuts they are now asking $399,885 – just three percent less than their 2023 purchase price. Assuming they won’t have to make any further price cuts to attract a buyer (LOL), they will lose about 33 grand on this transaction.

But will they be willing to cut the price further to close a sale? Let’s check the listing description for clues: “* Seller is highly motivated, Bring us an Offer! *”

Buyer: “Great! Since you’re highly motivated, my offer is $300,000.”

Seller: “No, not like that.”

Sellers claiming they are “highly motivated” is meaningless drivel – their level of motivation is demonstrated solely by the price. And with this series of chickenshit price cuts during the last several months, this seller only seems motivated to avoid the inevitable.

At 104 days on market it’s obvious the price still needs to come down more. But if they cut the ask to, say, $350,000 ($443 per square foot) then their entire down payment would vanish. Poof. Like a protein fart in the wind.

As a result, $350,000 is probably a significant financial and psychological barrier.

But what if the market says $350,000 isn’t low enough and they need to cut even more to garner a sale? I’m sure the seller would rather not think about a short sale, but the longer they wait the more that becomes a possibility.

At least the place looks pretty tidy.

But what is happening here? It looks like they used fire block foam but only in that one spot. And why does it look like there is a window inside the fireplace?!

Oh, because there is a window inside the fireplace:

And can we talk about this tiny fridge? What the heck is that?!

Anyhow, if some blundering fool comes along today and pays full boat, here is what they’re looking at:

Purchase price: $399,885

Down Payment (20%): $79,977

Monthly Payment: $2,738/mo (@7.4%)

That seems like a considerable chunk of change for a 789-square-foot cabin. But maybe the seller and their agent priced it right – how do you determine fair market value in this crazy market?

To answer that I feel like some historical context is important. Specifically, in 2018 before real estate went parabolic this same cabin sold for just $159,000. Sure it probably didn’t have the updated floors, kitchen and bathroom, but my point is just six years ago you could get a tiny, habitable Big Bear cabin for under $200,000.

It’s obviously worth more than $200,000 today, but anyone paying $399,885 is surely catching a falling knife. There is so much more downside coming for micro cabins like this.

But, if you can easily afford the $2,700 payment and won’t be bothered by losing equity every single year until we hit bottom, then you’re all set. Just buy it at full price, delete the Zillow app and enjoy your tiny refrigerator for ants.

Leave a reply to Tipped Off – Big Bear Bummers Cancel reply