This price reduction is notable because the seller finally, mercifully acknowledges they will not walk away with a profit. That dream is officially dead.

Psychologically it was probably difficult to give up on the promise of making money on their ill-timed investment. So, good on them for breaking through the fog.

However, before you think they had some profound come-to-Jesus moment, it’s worth noting they’re still hanging on to the delusion that they won’t lose money either.

Is that a realistic expectation?

I’ll let the market decide that one, although after being listed for 450+ days I think we all know the answer.

Their next psychological hurdle will be accepting that a sale will in fact result in losing money. I sense they’re not quite ready for that, but that day will come.

When that day comes is anyone’s guess.

***********ORIGINAL POST BELOW***********

Address: 42683 Falcon Ave, Big Bear Lake, CA 92315

Link: https://www.redfin.com/CA/Big-Bear-Lake/42683-Falcon-Ave-92315/home/4114443

Beds/Baths: 2 bed, 1 bath, 768 squares

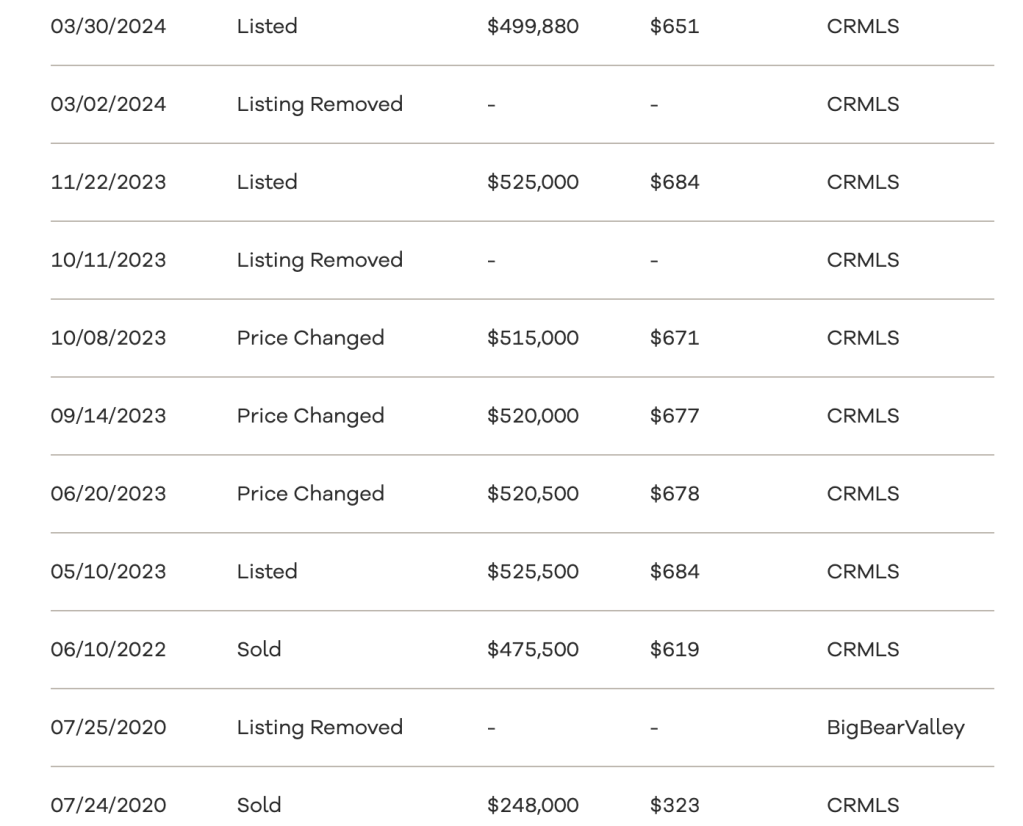

Purchase Price (6/2022): $475,500

Asking Price: $499,880

Difference: +24,380

Commission (3%): -$14,996

Total Gain: +$9,384

This poor soul purchased in June 2022 for $475,500, thinking nothing of the fact that the previous owner only paid $259,000 in 2020. Like, that kind of insane appreciation in just two years didn’t set off alarm bells that maybe there was a massive speculative bubble underway?

Anyhow, they didn’t even last a year before pulling the ripcord in May 2023. As is typical of recent buyers, they came up with an asking price of $525,500 that just so happened to cover sales commissions and ensured a nice little profit for their 11 glorious months of ownership.

Unfortunately, by spring 2023 the market had changed dramatically from the frenzied environment they purchased in, and they have been rotting on the market ever since.

In addition to wasting time with chickenshit price cuts, the seller has been playing the de-list/re-list game to conceal just how stale their listing has become. Although Realtor.com says this place has been listed for 130 days, the listing history shows it has actually been on the market for 450+ days.

What the hell are they waiting for? Do they think things are going to get better in the coming months? If they do, I have some overpriced Big Bear real estate to sell them.

The listing photos aren’t helping either. Especially considering that the photographer seems obsessed with taking close-ups of irrelevant stuff.

This is an especially odd close-up shot because if they were trying to show the bathroom faucet works, they should have put the water on full blast. This just makes it look like there is an unaddressed leak.

And the photos we actually want to see only highlight the drawbacks of this property, including how dark and dank it looks:

Yikes.

The photos also bring into focus how little privacy there is in the backyard (killer view of an abandoned boat though):

The listing description emphasizes the short-term-rental aspect, which conveniently overlooks the fact that it wasn’t profitable for our seller. How do I know? Because he’s trying to get rid of this place rather than sleeping every night on a pillow stuffed with VRBO cash.

“This cabin boasts a thriving reputation as a premier vacation rental, earning coveted super host status.”

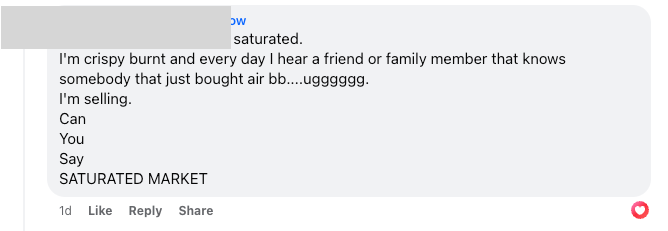

In case you aren’t aware, Super Host status is not attached to the property. If you buy this joint you will have to start from scratch to build your own clientele, garner positive ratings and achieve a reputable host status. All at time when the supply of competing rental properties is extremely high, rental demand is weakening and renters are becoming more entitled and less respectful (ask me how I know about that).

Although this Airbnb Facebook group is anecdotal and isn’t specifically centered on Big Bear, I have a feeling many “short-term-rental empires” are feeling this kind of pressure too.

Anyhow, assuming a sucker comes along today and pays full price, our seller will walk away with $9,384. Score!

But as usual there is a huge assumption built into that loss calculation: namely that this price is competitive enough to snag a buyer…which it clearly isn’t. Between the insane amount of days on the market, bad photos and huge monthly payment for a sub-800-square-foot cabin with a solo shitter, it’s not really a compelling property.

Purchase price: $475,500

Down Payment (20%): $95,100

Monthly Payment: $3,423/mo (@7.4%)

And as we covered in Nightmare on Elm Street and Greedy Gremlins, there is an enormous amount of competition in this little slice of lower Moonridge. As of today, there are around two dozen homes all competing for the same handful of eligible buyers.

If our seller has to cut the price by, say, 10 percent to attract a buyer, that would instantly guarantee a $39,000 loss. Nearly half their down payment gone with one modest price cut.

So psychologically I understand why they’ve been stuck at this unrealistic price for so long. It’s hard to accept that they’re not going to cash in on the windfall they were expecting, and will actually lose a bunch of money.

But the market doesn’t care about sellers’ feelings.

I understand how the recent decline in mortgage rates might be giving stalled-out sellers hope that they can still get their outlandish Wishing Prices, but if they truly want to get out they’re going to need to make aggressive moves…and that’s going to cost them.

The standoff continues…

Leave a reply to I Wear My Sunglasses at Night – Big Bear Bummers Cancel reply