Purchase Price (2/2022): $1,225,000

Sold Price: $1,132,300

Difference: -$92,700

Commission (5%): -$33,969

Total Loss: -$126,669

Damn. That is a devastating loss.

But if you’re serious about selling in the current environment, this is how you do it. Keep in mind their most recent asking price was $1,199,999, meaning they accepted an offer nearly $70,000 below that. THAT’S how desperate they were to get out.

And by ripping off the Band-Aid they managed to keep about half their down payment. Not ideal but it could have been a lot worse.

Delusional sellers stubbornly waiting for a miracle might not be so lucky.

***********ORIGINAL POST BELOW***********

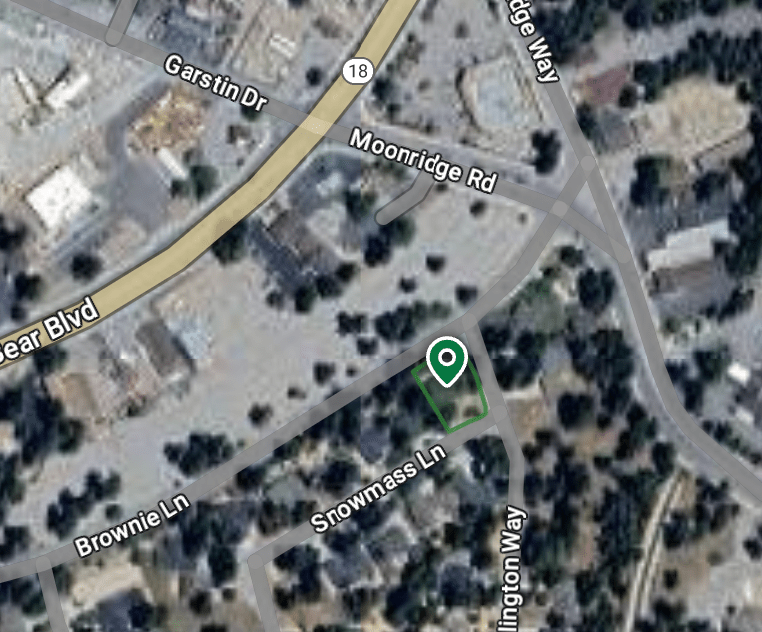

Address: 42128 Snowmass Ln, Big Bear Lake, CA 92315

Redfin: https://www.redfin.com/CA/Big-Bear-Lake/42128-Snowmass-Ln-92315/home/161180754

Beds/Baths: 4 bed, 3 bath, 2,257 squares

Purchase Price (2/2022): $1,225,000

Asking Price: $1,199,999

Difference: -$25,001

Commission (5%): -$60,000

Total Loss: -$85,001

In early 2022 our seller purchased this place for a whopping $1,225,000. That was an impressive $125,000 over asking price, demonstrating the craziness of the pandemic-era frenzy. However, given that this was a super rare, new-construction home walkable to Snow Summit (sort of), I kind of get it.

Unfortunately, by May 2024 they realized they got in way over their head and listed it for 25K more than they paid to try to minimize losses. After commissions that price would have meant eating around $37,000. Not terrible compared to some of the financial disasters we’ve featured, but still probably not what he was expecting when he bought just two years prior.

Shortly after another price reduction to $1,199,999, they went pending. And now we wait to see what it closes for and how bad the losses are.

It might go for full asking price given how good everything looks (it should look good considering it was built just three years ago), and the owned solar panels are a major plus.

However, I noticed there is no hot tub, which seems odd for such an expensive place.

But then you see that the property is right on Brownie (a major thoroughfare for ski shuttles and people driving to Snow Summit) and the photos show there isn’t much privacy in the back yard.

If you can see the adjacent parking lots, then the adjacent parking lots can see you. No hot tub is probably for the best.

Anyhow, assuming the new buyer pays full boat, what kind of payment are they looking at?

Purchase price: $1,199,999

Down Payment (20%): $240,000

Monthly Payment: $8,151/mo (@7.3%)

That’s a big monthly outlay, but not a problem for someone swimming in these high-priced waters.

But is their job secure enough to keep making a monster payment on a vacation home if the economy goes south? Let’s hope they know what they’re doing because I foresee a lot of downward pressure on prices and don’t want to see the new owner in the same boat as our seller in another two years.

Leave a reply to PRICE CUT: 2-4-1 – Big Bear Bummers Cancel reply