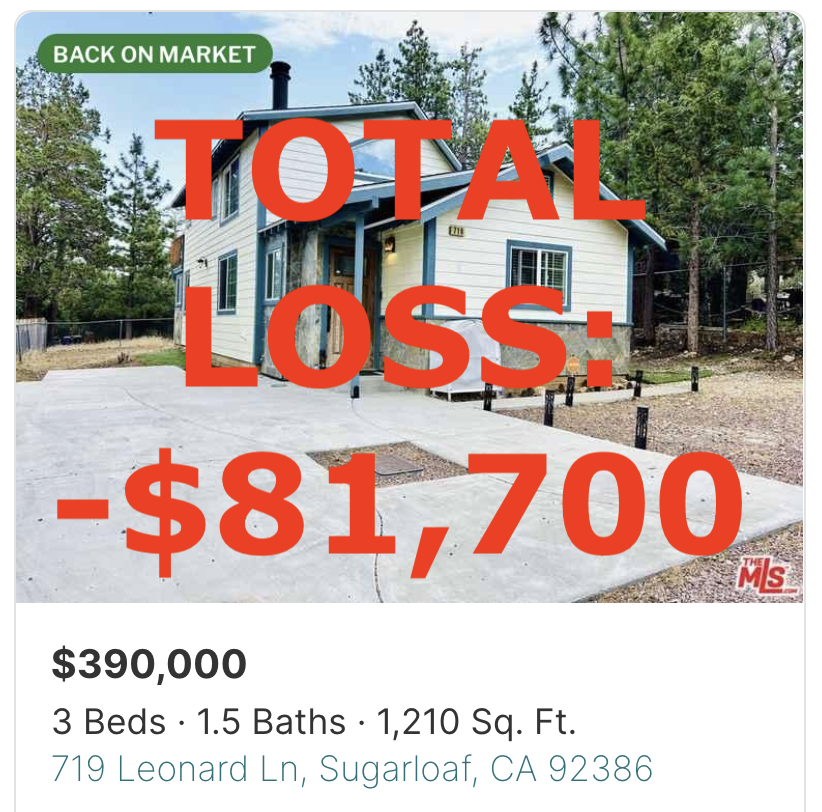

Address: 719 Leonard Ln, Sugarloaf, CA 92386

Link: https://www.redfin.com/CA/Sugarloaf/719-Leonard-Ln-92386/home/4124266

Beds/Baths: 3 bed, 1.5 bath, 1,210 squares

Purchase Price (7/2022): $460,000

Asking Price: $390,000

Difference: -$70,000

Commission (3%): -$11,700

Total Loss: -$81,700

We have covered Sugarloaf before, and established that in a declining market it’s a really tough sell. That’s because as prices come down in more desirable areas of Big Bear, it’s much more difficult to justify purchasing out in the boonies.

I feel like the only reason people bought out in Sugarloaf during the pandemic-era frenzy was that they were priced out of the good areas of Big Bear proper. And Sugarloaf provided a more affordable way to set up an Airbnb “business” and still get in on the burgeoning short-term rental game. Sure, the rental income was lower but so was the cost of entry.

The problem with that kind of thinking is that it only works in a rising market. When real estate crashes, location suddenly becomes important again. And properties in far-flung areas, no matter how cheap, have a really tough time finding buyers.

This is especially true for properties that aren’t fully dialed in like this one. This place could use some love.

This seller is in deep shit.

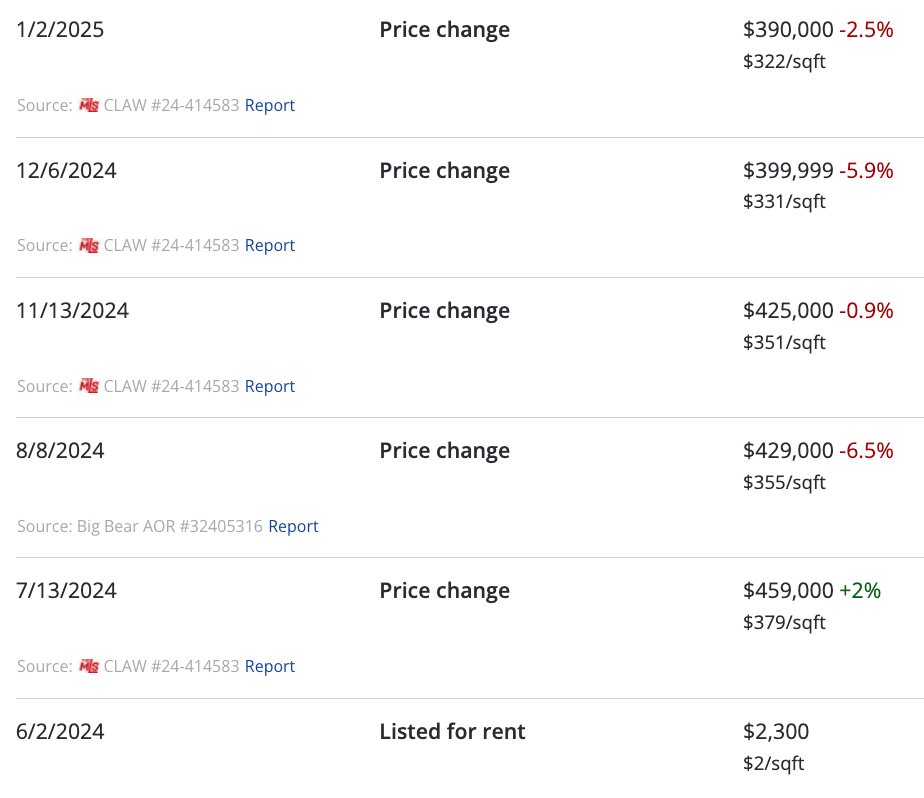

Caught up in the pandemic-era frenzy, they WAY overpaid in 2022 and are now staring down the barrel of a massive financial catastrophe. By July 2023 they knew they were in trouble, and went for a Hail-Mary asking price of $489,000. That price would have miraculously allowed them to get out of their financial mistake with a little bit of cash in their pocket.

But the market had other ideas. And after an eternity spent chasing the market and trying to rent it out they are now stuck at $390,000 – $70,000 less than they paid. After commissions, they are looking at a loss of roughly $81,000.

Keep in mind their down payment was $92,000. If they cut the price any more, that entire amount will be sacrificed on the altar of the Price Discovery Gods. And if it still doesn’t sell, then it’s time to call up the lender and beg for a short sale.

My philosophy is to buy the crappiest house in the best neighborhood – location ALWAYS matters. But whatever you do, don’t overbid on the crappiest house in the crappiest neighborhood or you could end up like this poor sucker.

What do you think?